Knowde: The Central Knowledge Node of Chemicals

Startup Spotlight #15

Note: This is such a great company. Thanks to Shaun Maguire of Sequoia Capital for the tip. If you enjoy this piece, please subscribe for further deep-dives just like this one! More to come!

Almost everything you are interacting with at this given moment has one thing in common... they use chemicals. Phones. Computers. Clothes. Most foods & beverages.

And yet, how much do you know about the chemical industry? Probably not much. It is very opaque. Where does one even find chemicals? Turns out, that is a hard question to answer, even for industry experts.

Enter Knowde. The one-stop, digital chemical marketplace. Knowde is quietly becoming a centerpiece of one of the largest industries in the world, and the downstream effects on innovation will be remarkable.

The Context: The building blocks of... everything

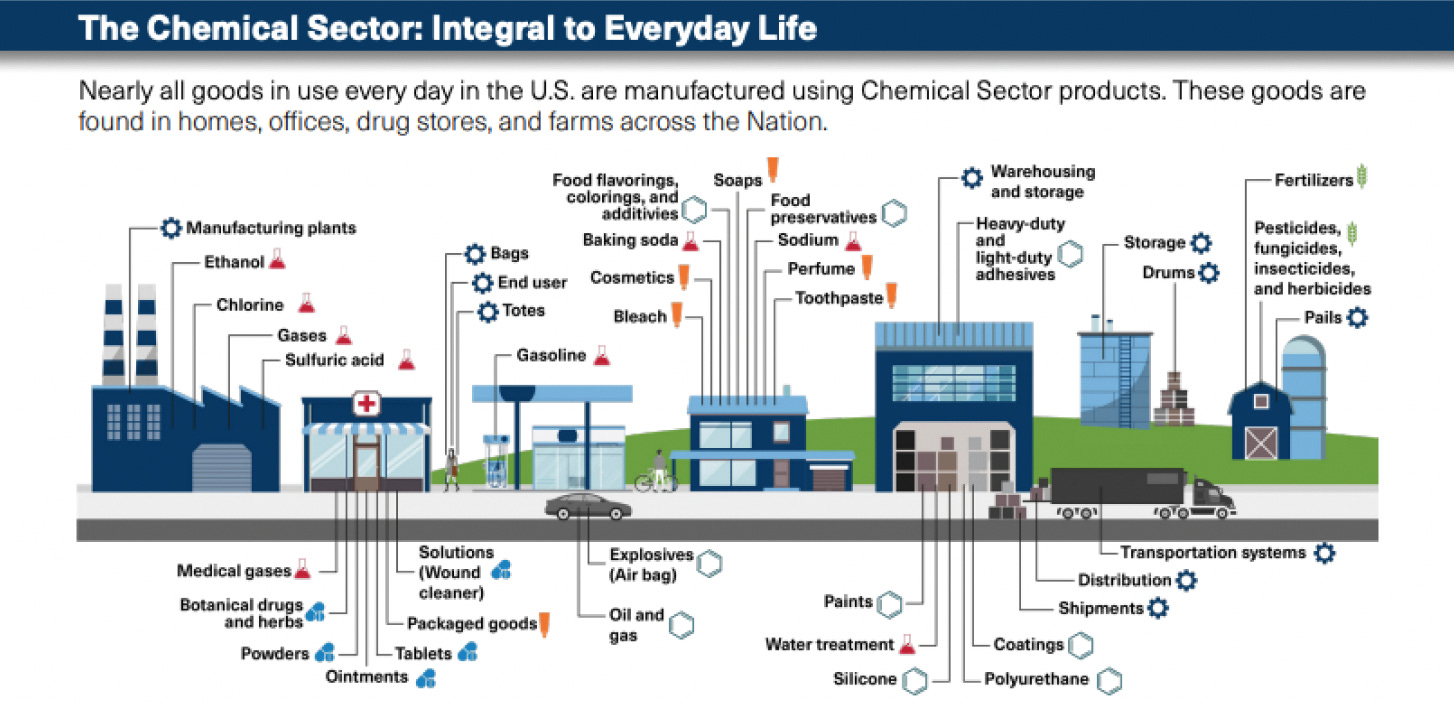

Nearly all goods have a dependency on the chemical sector. Whether it is your office, your home, your car, where you shop... literally everywhere.

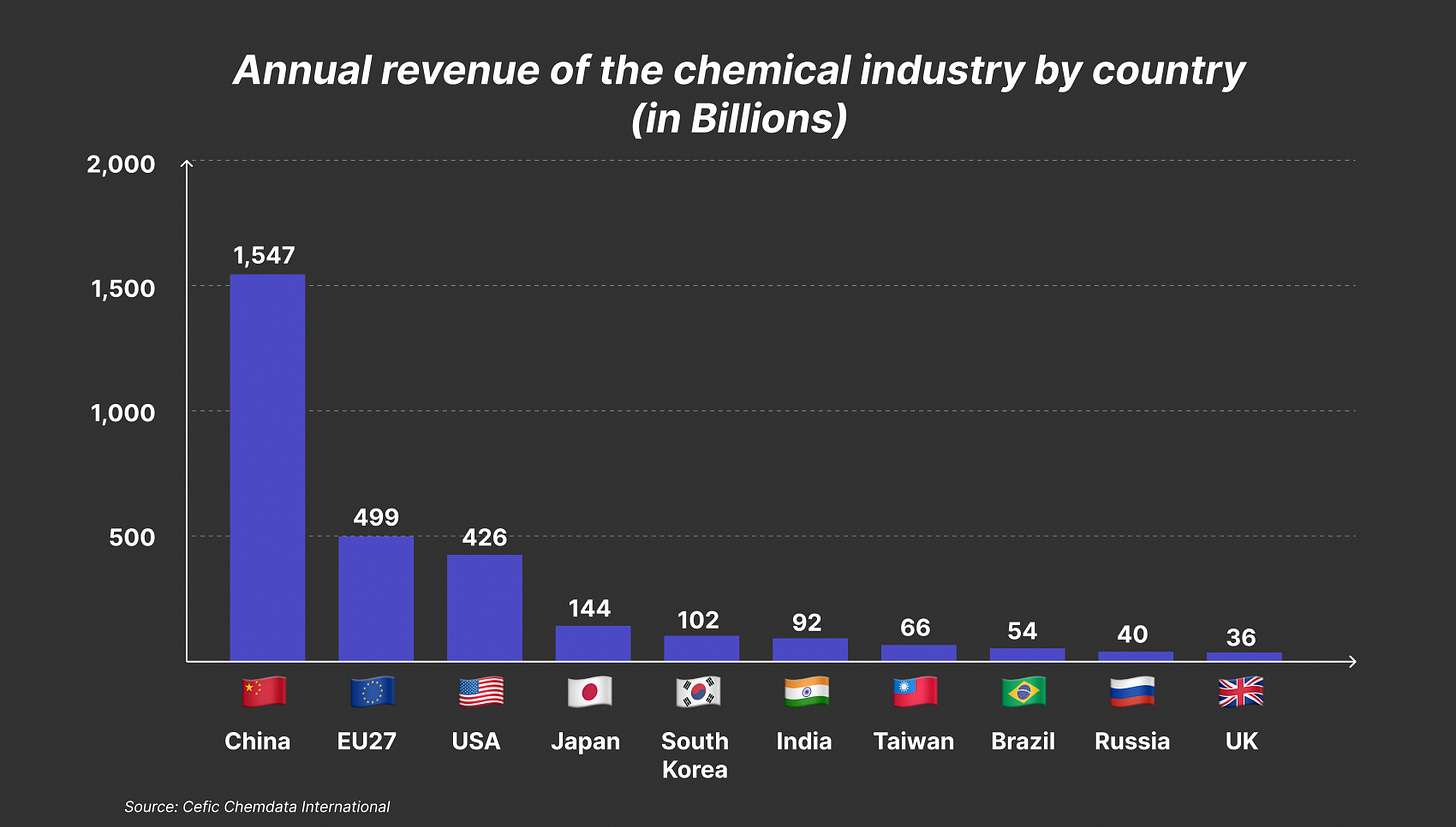

At +$4 trillion in annual revenue, the worldwide chemical market is MASSIVE, and it continues to grow at relatively modest ~2-5% rates.

China is the clear leader in chemical production, and over the past ten years, that shift has increased significantly.

Even as a third player, the US market is +$400B (according to Exhibit 2) and +$700B by CISA estimations (estimations vary based on inclusion of pharmaceuticals and other sub-categories).

By shipments distributed ($), CISA breaks the US industry into five categories: agriculture, consumer, specialty, pharmaceuticals, and basic. Basic chemicals (including petrochemicals) and pharmaceuticals make up roughly 70% of the US chemical market.

The scale of this market is hard to fully capture. Here are some stats:

The chemical industry employs +800,000 people in the US

~10% of all US exports come from chemicals

There are 11,000+ US chemical manufacturing facilities

+30% of those facilities are small and medium enterprises

In addition, this market is anything but stagnant. Petrochemicals, plastics, etc., may feel traditional (and maybe some of it is), but the industry is ever-changing. Deloitte highlights four main trends in the chemical industry:

Sustainability and innovation - Stated objectives to reduce Scope 1, 2, and 3 emissions by 2030 will put pressure to use more sustainable methods

Portfolio transformation - Current strength in financial position gives this industry opportunities to invest in long-term big bets

Supply chain - Recent macro trends (geo-politics, COVID, sustainability) are causing everyone to rethink the resiliency and implications of their supply chain

Digital - Innovation in all aspects of chemicals (e.g., development, distribution) pave the way for digital savings and insights

#1-3 anchor heavily on repositioning the chemical industry to survive with a lower carbon footprint and international dependency. We have already begun seeing the massive ship start to turn. BASF (third largest chemical company in the world) is projecting stronger chemical growth for the United States (1.8% → 4.5%) compared to weakening growth in Chinese chemicals (7.7% → 4.0%). This will not impact market share much, but it is something to watch over the next decade.

The Problem: Entering the new age

Today, if you are an end-buyer (e.g., Pharma, Beauty), it likely begins at the highest levels of strategy. A C-suite executive says, "We need ____ to win ____ market!" Maybe it is sustainability. Maybe it is just a different type of product. Regardless, the royal decree is given, and likely, it is up to Research & Development (R&D) to make magic happen.

This process is not simple. It is highly variable by industry, depending on factors like complexity and regulation. It usually starts, however, with R&D doing extensive research on chemical compounds, sourcing potential solutions, and then testing formulas, until a solution is found.

It is hard to make specific estimations cross-industry, but a few key themes emerge:

Spray and pray method: "The vast majority of molecules synthesized in the R&D phase will never make it past the first few assays... approximately 100 kilograms of chemical waste are generated for every kilogram of viable product." (Source)

Iterative testing: "Once the ingredients have been identified and sourced, there is an R&D phase that takes anywhere from three months up to a year or sometimes more. It really depends on the complexity of the formulation and how many rounds of prototype submissions it takes to get to an approved formula." (Source)

Desire to improve efficiency: "As development costs mount to often-unsustainable levels, and regulatory requirements continue to tighten, pressure to increase R&D efficiency mounts ever higher." (Source)

Chemical supplier bottleneck: "And, if you think it takes a while for private-label companies to get back to you, you should start emailing the chemical companies they’re usually waiting on." (Source)

But why do these problems exist? Well, I break it into a few key problems:

#1: Fragmented suppliers

The US alone has 11,000 suppliers. 30% of them are small and medium enterprises. This is not inherently a problem. As a matter of fact, there are many benefits to having this level of competition.

But this much competition can make differentiation and comparing hard! For example, a quick, non-exhaustive list for Polyethylene providers yields an extremely long list. All of which is unlinked and contains limited information. Regardless of industry, small and medium enterprises often also run leaner. Many of these smaller businesses have less resources of time to allocate to digital solutions that could help the R&D discovery process.

#2: Unstructured and siloed information

As a result of the industry fragmentation, much of this information exists in PDFs and siloes across the internet. In addition, everything is labeled differently.

A quick sample across four larger chemical producers (DuPont, Dow, Polynt, and Sasol). While their product portfolios are differentiated, they do have overlapping products, and yet, the navigation, naming, etc. is entirely different.

This creates a first challenge for R&D scientists. How do they even find the information they are looking for?

If they do correctly navigate to solutions, it is all hidden in PDFs. For example, if we look at DuPont adhesives, we may navigate to MEGUM, a rubber-to-substrate bonding (don't worry about what that means). Once you get to their page, you can find links to PDFs for more information.

This is like the Yellow Pages. Having a phonebook like that is better than not... but it's still pretty crappy given the technology we have today. Essentially, each scientist would need to:

Search for solutions

Navigate tens of supplier websites

Figure out their taxonomy and identify chemicals that may (or may not fit their need)

Download all of the respective PDFs.

But wait! There's more!

#3: Apples to Oranges

Even if you get to this position, it is STILL not the same. There is no overarching taxonomy, but there also are not any required documents they MUST list on their website. Even then, many of the documents leave a lot to be desired. Most of the statements appear to be qualified with relative terms that largely... help very little.

Phrases include:

"Under certain circumstances..." → Proceeding to give zero details on these circumstances

"Towards aggressive liquids..." → Of which none are named

"Relatively high heat..." → Could be entirely subjective

Admittedly, most of this is unavoidable. It is a clear way to avoid over-committing or being held to specific metrics. It makes sense. That being said, if you are an R&D scientist and there is no structure, true requirements, and terms are all relative, then how do you adequately compare?

You test! The most important part. But to do that, you need answers and samples.

#4: Manual dependencies

But let's say you wade through all of this information. You're 80% of the way there, so you want samples, so you can test. The industry is very old school. For the majority of suppliers, you must talk to a sales representative to get started. Less than $5B of chemical volume is sold entirely digital.

Most webpages end with a basic contact form. For Dupont, I am just submitting my email to a dark abyss (Note: I tested some; response time was very slow, but some may have realized my info was fake). Ultimately, I hope they respond, OR I call direct. Large scale companies may be fairly strong, but consider the small-to-medium businesses that have less formal processes. Many of these leads are likely managed with paper.

None of this is terribly surprising, but consider the scale at which R&D must do this. Elsevier says that, "the vast majority of molecules synthesized in the R&D phase will never make it past the first few assays." Elsevier estimates that for every 1 kilogram produced, there is ~99 kilogram of chemical waste.

The waste is a different topic. For now, just consider the pain for R&D. They have to research thousands of chemicals. They eventually need to manually reach out to hundreds of sales reps. This is all before they event test. This is a huge challenge. One industry expert said: "And, if you think it takes a while for private-label companies to get back to you, you should start emailing the chemical companies they’re usually waiting on." (Source)

#5: Unscalable operations

This is a problem on both the buyer and seller side. Think about how tech sales work. Sure, there is still very manual support for large enterprise and commercial accounts. There always will be. People want the option to call someone, and if you have a limited number of accounts, you can scale sales to manage.

But for smaller accounts, free trials, self-serve, etc., all exists for rapid response. And companies use tons of software like Salesforce, etc., to manage all of their leads.

The majority of chemicals has not adopted this. For both R&D and the sellers, much of this is likely managed in excel sheets or word docs. Maybe worse. Notepads. For these reasons, sample shipping, purchase orders, etc., or often time-consuming and delayed. It just does not scale.

#6: Decelerated innovation

This is just the first loop. Throughout the process, R&D tests and iterates. Ordering more samples. Maybe ordering different chemicals. It is a process.

This entire process is currently slow, and it has a ton of friction. All of this waste decreases the speed of iteration, and ultimately, it actually decelerates innovation of the industry as a whole.

The Solution: A central node of knowledge

Compare this to the purchase experience most of us experience. Go to Amazon. Filter by whatever we want. Scroll. Find options. Purchase. Easy enough. It is all there for us, and it is fast.

Of course, chemicals are not the exact same... but it could be! Knowde is creating the single platform for the entire chemical purchase lifecycle to take place, and ultimately, this could speed up innovation in the entire industry.

For all of the reasons mentioned above, the chemical industry is very opaque and traditional. Changing the industry and solving these problems requires someone who knows it well. But often, the person who knows it well is unlikely to change it. Enter Ali Amin-Javaheri.

The perfect founder for the job

Ali is one the best founder-market fit stories I have heard. Sequoias piece on Ali's "Chemical Romance" explains it in length. It is worth the full read. You will not be disappointed. I will attempt to give a summary because I think it is critical to understanding how Ali & Knowde are solving these problems.

Ali's father studied chemical engineering at Maryland before returning to Iran to work at Dupont. In 1985, geopolitical issues pushed them to immigrate to Houston. Unfortunately, Ali's father was unable to get a job that matched his experience in the US. Working hard to support his family, his father took non-chemical jobs, but it was unjust. As a result, "Chemistry took on mythic proportions in their household, coming to represent the peaks of hard-won success...the life that got away."

Ali grew up in the Seattle area. Throughout his childhood, he spent nights and weekends reading chemistry-related books and magazines. He loved it. It was his passion.

But in college, "immigrant practicality overtook academic interest," so Ali studied information systems. It was a path to stable job in tech in Seattle. After graduation, he was strolling in Bellevue when he saw ChemPoint. It was a company trying to change the way marketing and selling was done in chemicals. He applied and joined. Ali worked there for 11 years.

By 2017, he had the perfect combination of experience. A lifelong passion and knowledge of chemicals. An education in technology. 11 years of operational experience at the intersection of those two. ChemPoint's vision veered from Ali's, so he went off to build his own... Knowde.

One marketplace to rule them all

(#1) Fragmented suppliers make it impossible to find options. Creating a unified marketplace (Amazon example) is the obvious solution, but two-sided marketplaces are hard. The two sides:

Supply-side: Chemical suppliers listing their products

Demand-side: R&D professionals research and buying products

If you get the demand-side with no supply, then R&D professionals would come to the website, see no chemicals, and never return. If you get the supply-side but no demand, then chemical suppliers will list their products, get no response, and stop updating. The marketplace only works if you get both. Which is hard.

Ali had experienced this problem. During the dot-com boom, many people tried this same thing, but they all failed (w/ the exception of ChemPoint). They would get 10-20 suppliers, but that is nowhere near enough. There are 11,000 in the US alone. Here's how they built this marketplace:

Systems to onboard

Sell, sell, sell

SEO

The secret sauce of Knowde starts with the behind-the-scenes work. Chemical suppliers do not want to spend hours, days, or weeks uploading hundreds and thousands of documents to a new website, particularly if they are unsure of the value. It was clear that Knowde would need to do this for them. Remove all friction.

Well... if you want to onboard thousands of suppliers and they have thousands of documents... that gets complicated quickly. Knowde needed to build systems to onboard suppliers frictionlessly. For example, they needed to process millions of unstructured PDFs. For ~2-3 years, this is what Knowde did. The information systems background was paramount to Ali even getting started!

Once onboarding was frictionless, the sales process becomes a bit easier. Just give Knowde a data dump, and they will create a storefront for you (see above).

Suppliers had heard this though, so Knowde had to sell, sell, sell. COVID restrictions helped this process because the large chemical events were not happening. People needed solutions. So Ali hit the road. Driving through Texas, Tennessee, etc. selling big suppliers. And in the background, the Knowde systems were pumping away creating the ultimate chemical database and marketplace.

From July '21 to July '22, Knowde has added 5,000+ suppliers, and they have reached 8,000+ suppliers!! They are processing 100+ new supplier storefronts per week. This scale is remarkable. This is just supply-side, however.

In parallel, they have been structuring everything to be super discoverable via SEO. This will build the demand-side.

The strategy has 6X'd monthly visitors from search engines. Quickly, the marketplace activity has formed on both sides.

Structured taxonomy

None of this information had ever really been in a single place. While the suppliers remain fragmented, a unified marketplace brings them to a single location. But all of the information has always been (#2) unstructured and siloed. So now you have it unified, but how do you find anything?

Knowde had to create a new industry, standard taxonomy. Remember Exhibit 8? With Knowde, users can view all products based on:

Markets - Paints & Coatings, Personal Care, etc.

Technologies - Animal Feeds & Nutrition, Plastics, Pharma, etc.

Suppliers - DuPont, Dow, etc.

Sustainability - List of sustainable technologies

Once you click into one, you can use a variety of sub-groups, filters, and more to navigate to the exact list of products you are considering.

Instead of days or weeks of web-scraping to find siloed PDFs, professionals can go from 100,000 options to their short-list to test in minutes.

Comparable product pages

Once you find interesting products, you can compare them much quicker. Before, you may need to download PDFs that are entirely different formats, look for information, and take notes.

With Knowde, you can add interesting products to a list, and you can use product pages to instantly compare important information. No more (#3) Apples to Oranges comparisons. All of the information needed to make the first decisions in one place!

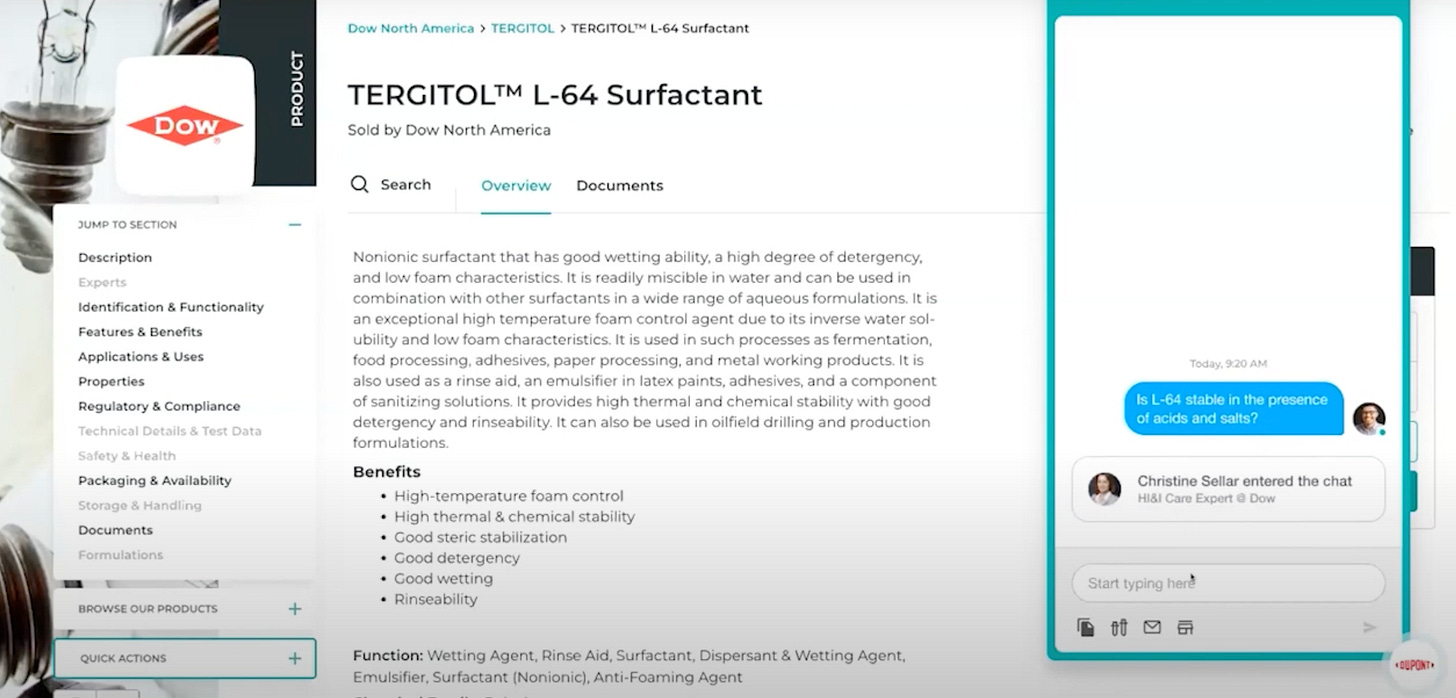

Digital communication

Of course, there will still be gaps in information. There always will be. Typically this requires submitting a contact email form, or the R&D scientist may need to just pick up the phone.

On Knowde, users can use the "Experts Online" button in the bottom right to ask follow-up questions. This can help fill gaps and compare very, very quickly.

Experts can even recommend other product pages to help the search. Once the scientist has found their short list of chemicals to test, they need to order samples.

No more need for complete reliance on pen & paper. The (#4) Manual dependencies are greatly limited with all research, sample ordering, follow-ups, etc., fully digitized!

Scalable CRM

Ultimately, this still relies on a sales rep, but the exchange is MUCH faster. While the marketplace is the main focus, Knowde is actually a B2B SaaS backend (right now) that is giving chemical suppliers tools like CRMs, Digital Analytics, etc. to scale.

On the supplier side, their sales reps can now see all of their conversations in one holistic dashboard, including key details on previous conversations, leads (e.g., specific products), and more.

The console gives holistic account & lead information.

Suppliers can manage all digital communications from the console as well, including sending in-app notifications with additional information or materials.

They can even target anonymous viewers with notifications like an emoji hand wave!

Even if you do not work in chemicals you are probably sitting here mindblown. In <5 years, the chemical suppliers are jumping from an industry bottlenecked by (#5) unscalable operations like pen & paper to a CRM and scaled digital selling tool that is better than most state-of-the-art technology companies.

(Note: A great view of the business model can be seen in Contrary Capital’s writeup)

Accelerated innovation

This leads to the most critical part. Knowde's name comes from the combination of Node & Knowledge. Creating the center point of knowledge for the industry. We know chemicals are the center of basically every industry. Until now, it has been unnecessarily slow and inefficient, leading to (#6) Decelerated innovation.

But imagine if every R&D time drops from 6 months to 5 months. Seems minor, but compound that across thousands and thousands of companies. Not to mention, suppliers are getting better at supporting and understanding customers.

These iterative loops will all slightly tighten, leading to a significant change in the industry!

Conclusion: The path forward

Believe it or not, Knowde is just getting started. For ~5 years, Knowde has been building the critical foundation. Systems to intake information and organize it. Taxonomy and a web interface to make it easily discoverable. Building a two-sided marketplace. Communication tools to make the experience seamless.

Earlier, I mentioned that less than $5B of chemical volume is sold entirely digital. Turns out, that has been completely flat. Long-term, I could see a world where Knowde expands in a few huge ways:

Normalizes fully-digital chemical sales & processes serious GMV

Becomes an ultimate data source of chemicals & trends, leading to insights that push the industry forward

In the former, Knowde becomes the ultimate platform. In the latter, Knowde also becomes a data provider. Both will be extremely exciting.

Appendix

One pager

Market sizing

There are probably three main business models that Knowde can pursue:

SaaS - CRM

Ads - Digital marketplace

Digital transactions - % of GMV

Right now, Knowde is #1 + they charge an annual fee for the actual storefront. This is very profitable, and it is a solid business. For example:

800,000 US employees in Chemicals

Assume up to 25% in sales

Assume Knowde charges $50/seat

This would be ~$120M in ARR

Plus, the annual fees for stores are strong profits as well. This will only increase as traffic does. It’s hard to know how high this is, but it’s on the order of tens of million (maybe hundreds) per year. Some of this might be over-estimated, but it does not include international opportunity. That could potentially 5-10x it, creating a multi-billion dollar business.

Stacking ads on top would be super high margin TAM stacked on top.

Ultimately, the super high end would be capturing transaction fees. Consider this:

$5T market

Assume 10% transacted online

1-2% transaction fee

~$5-10B in revenue

Likely, their huge opportunity is being a combination of these three.

Macro factors

Digital transformation - Chemicals is an archaic space, but COVID forced the industry to modernize. This has given tailwinds to new tools like Knowde to be much more efficient

Sustainability - Pressure to adhere to climate standards are causing companies to invest heavily in R&D; this means they are rethinking how they build things (w/ chemicals)

Consolidation - The US industrial base has been declining; much of chemicals has shifted off-shore. If that continues, it will likely be a harder market for Knowde to win; if it reverses, you could see a wave of consolidation which inherently will make a marketplace less critical