Lambda School: Reimagining secondary education in America

Startup Spotlight #7

Every day, founders & operators everywhere are building new technologies and companies that should us optimistic about tomorrow. My goal: champion some of these founders, companies, and industry trends. Join thousands of investors, operators, and founders on the mailing list!!

The Problem: Our Education System is Broken

Universities have been foundational to America since the start (>10 universities founded before 1776). Hundreds of years later, there are thousands of universities. Universities, however, are challenged today more than ever. Digital transformation directly challenges the value proposition of a physical college campus, and COVID-19 created a forced pilot of digital learning.

Meanwhile, schools like the Lambda School are rethinking the core foundation of advanced learning itself. Traditional institutions once viewed this competition as niche, but with over $16.1B of VC funding in 2021 alone, edtech is exploding.

With this in mind, I think there are three main reasons universities are falling behind:

Investment

Institution

Incentives

Investment: The overwhelming cost of college

Every year, the US university system ranks #1 in the world. ~2X more international students come to study in the US than any other country. These statistics only tell part of the story. While we have some of the most prestigious universities in the world (~30 of top 100), I would argue the system as a whole is completely under-serving the general public.

First, consider the current cost of college. The cost of college has increased 25% in the last 10 years.Exhibit 1 shows the cost of college for public institutions, private and for-profit, and all institutions (aggregate) increases over time, but so does the median income of the middle quintile of Americans. Since 2001, private college is actually more affordable (64% vs. 73%), but the cost is still roughly two thirds of the average American’s household income.

Exhibit 1: The cost of college over time

Exhibit 1 looks solely at the middle quintile, but if you look at the top & bottom, it tells an even scarier story. In Exhibit 2, we look at the cost of college as a % of income by American quintiles. For those within the bottom quintile of income (ie. lowest 20% of earners), the cost of college ranges 120-290% of their annual income. It would take one to three years of saving 100% of their pre-tax earnings to pay for one year of college.

Imagine this. An American pledges to save 10% of their annual income for their kid’s college. To pay for a private institution, an American in the bottom quintile would need to save for ~120 years. Meanwhile, the top quintile of earners could save that money in roughly two years.

Exhibit 2: Cost of college relative to income quintile

Roughly speaking, college is ~30x more expensive for bottom quintile Americans when compared to top quintile, and ~6x more expensive for middle quintile Americans.

There are obviously many more factors, and there is, of course, financial aid. The main point is that college is not affordable for the average American (middle quintile) or poor American (bottom quintile), but it is very affordable for top quintile Americans.

This size of investment in college is fairly unique. Exhibit 3 shows that, as of 2016, the United States spent $30,165 per full-time equivalent student compared to the world average of $15,556.

Exhibit 3: Higher education spending by country (Source)

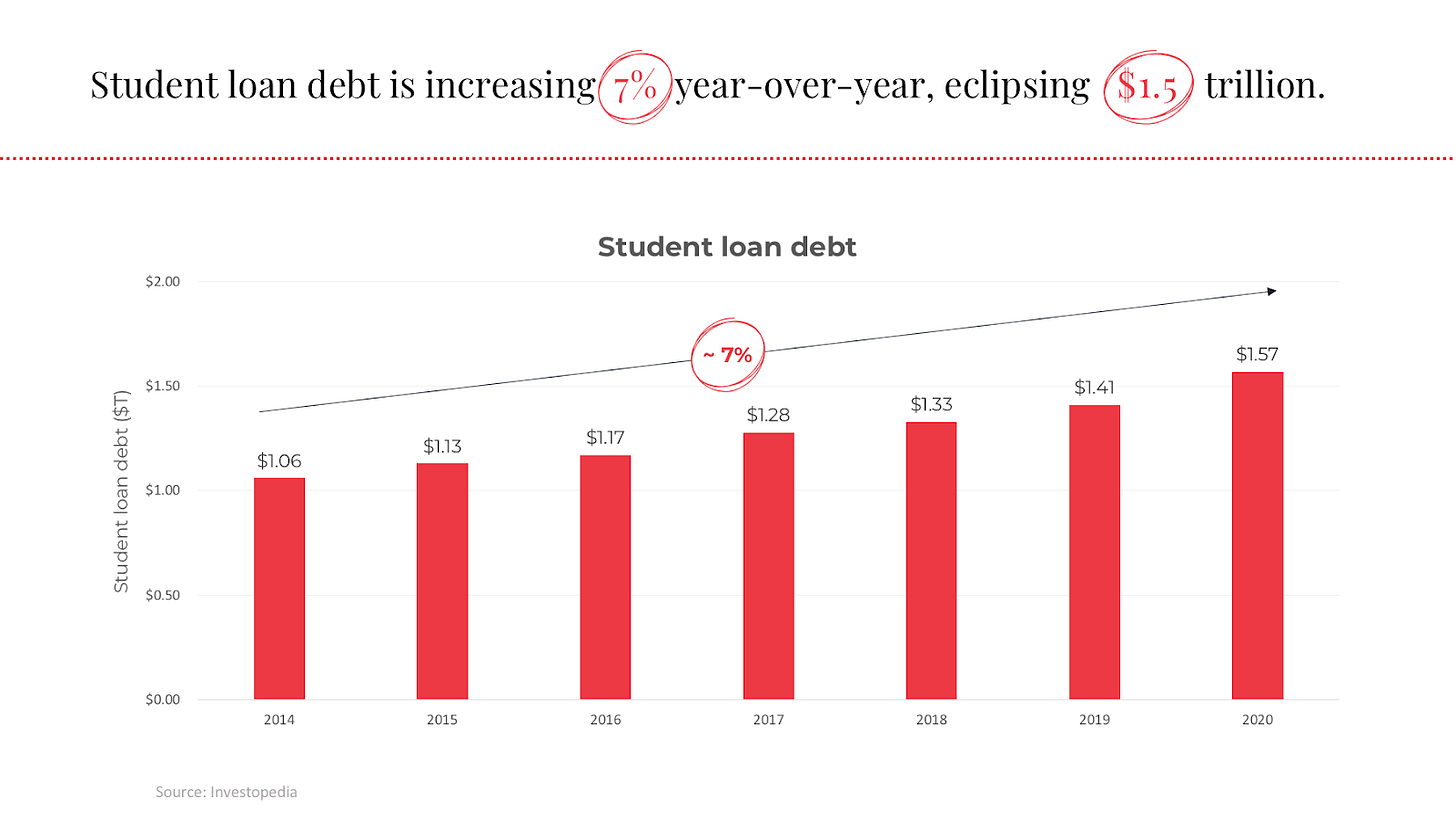

And while much of this spending is government subsidized, an outsized amount is landing on students that cannot afford college (likely lower quintile households). Exhibit 4 shows national student loan debt has ballooned to $1.57 trillion in 2020, and it is increasing at ~7%.

Exhibit 4: U.S. student loan debt over time (Source)

Millions of Americans are tying their financial future to the success of these colleges. This investment cannot be taken lightly, so surely, all of this spending is worthwhile…right?

Institution: The static nature of a tenured bureaucracy

The entire goal of a university is to prepare our youth for the workforce. The explosion of technology has changed the workforce at all levels. We depend on our secondary education system to adjust accordingly, so how is it doing?

As of December 2019, the unemployment rate for 22 to 27 year olds with a degree (~3.6%) was significantly lower with those without a degree (6.5%). Many would use this as a proof point of college, and maybe it is. It could, however, be a causation vs. correlation debate. People who attend college within the current system may be much more likely to fight for employment, so how do we know whether college caused it?

First, I would look at the relevance of the college degree to their occupation. The New York Federal Reserve Bank estimates that ~43% of college graduates are underemployed as of February 2021, meaning their major did not directly relate (or was not required) for their occupation. Unfortunately, this is not new. Exhibit 5 shows this trend over the past thirty years.

Exhibit 5: Underemployment over time (Source)

In truth, almost half of college graduates will not directly use their career in their occupation. For that portion of people, their education may not have been relevant (or worth the investment). Many would argue, however, that the overall educational experience prepared them for the job, and in some cases, it likely got them the job.

In October 2020, of the one million 20 to 29-year olds that received a degree year-to-date, roughly 67% were employed. Pre-COVID the number was ~76%. It is estimated that it takes 3 to 6 months for a college graduate to find a job.

These numbers come at a time of severe talent shortages across the United States. Daxx estimated there would be 1.4M unfilled computer science jobs at the end of 2020, increasing year-over-year. This results in ~$160B in lost production. Computer Science is not the only field. Monster highlights 10 fields in total struggling to find workers, with ~68% of HR specialists struggling to recruit people.

Overall, there is no dispute that universities play a critical role in the US, but there is some question around the current effectiveness. Tuition is expensive. People are putting themselves in debt to attend. There are massive opportunities for jobs. But for some reason, many go unfilled, and many students end up underemployed.

Our society and our students need quick solutions, and unfortunately, institutional challenges like accreditation requirements, tenured professors, established programs, and ingrained beliefs prevent traditional universities from pivoting quickly enough.

Incentive: Colleges receive payment...regardless

Even if a college recognizes the need to pivot, they are not incentivized to do so. Sure, long-term, one could argue that student success and employment rates will be critical to overall school prestige and enrollment, but is that true? For the most part, college rankings stay pretty static. Even if it does balance out in the long-term, students in the short-term are victims.

Students pay tuition up front, even if that means placing themselves in overwhelming debt. The tuition is paid regardless of school performance. The school’s job is to educate students and prepare them for the workforce, but we do not hold them to it.Upfront payments regardless of actual performance. It is a weird societal standard that we do not challenge, but imagine if we applied that logic elsewhere (e.g., jobs, childcare, taxes… oh wait).

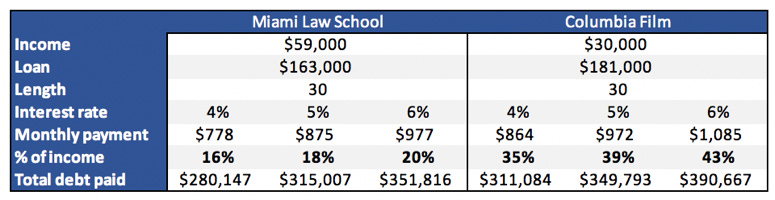

Here are two recent examples.

Median student debt: $163,000

Median income (two years later): <$59,000

Columbia University Film Program:

Median student debt: $181,000

Median income (two years later): <$30,000

If you assume that debt and income over time, Exhibit 6 shows you would be paying ~15-45% of your monthly pre-tax payments to just pay down debt.

Exhibit 6: Assessing cost of Miami Law and Columbia film

Likely, at those levels, you are not able to even start paying down the principal until years later once you have achieved a raise. Basically, the median student at these schools is likely to spend 20-30 years with their paychecks being drained by student loans.

And what happens to the school? Nothing. They have been paid, and as long as they meet their accreditation requirements, they continue to receive Title IV funding from the government.

It is important to note that this is not specific to Miami or Columbia. These are just the examples I have. This is happening everywhere, and ultimately, schools continue to churn over-levered, underprepared students with no repercussions. All blame is placed on the student (who likely made that decision at 18 years old).

The Solution: Reimagining workforce skill development with Lambda School

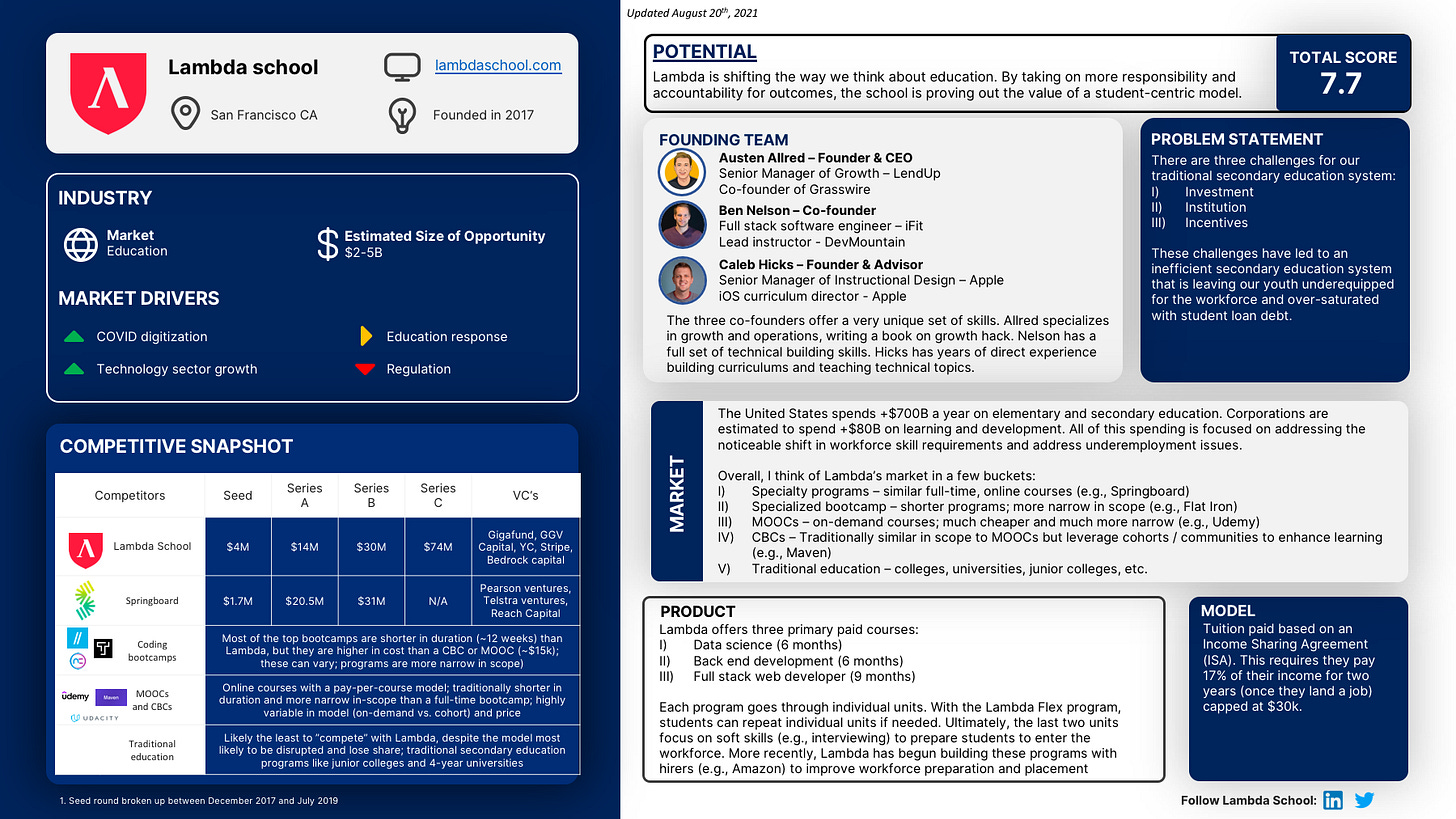

Lambda School has created a new model of education that is allowing students to bypass traditional methods and develop technical skills both effectively and efficiently.

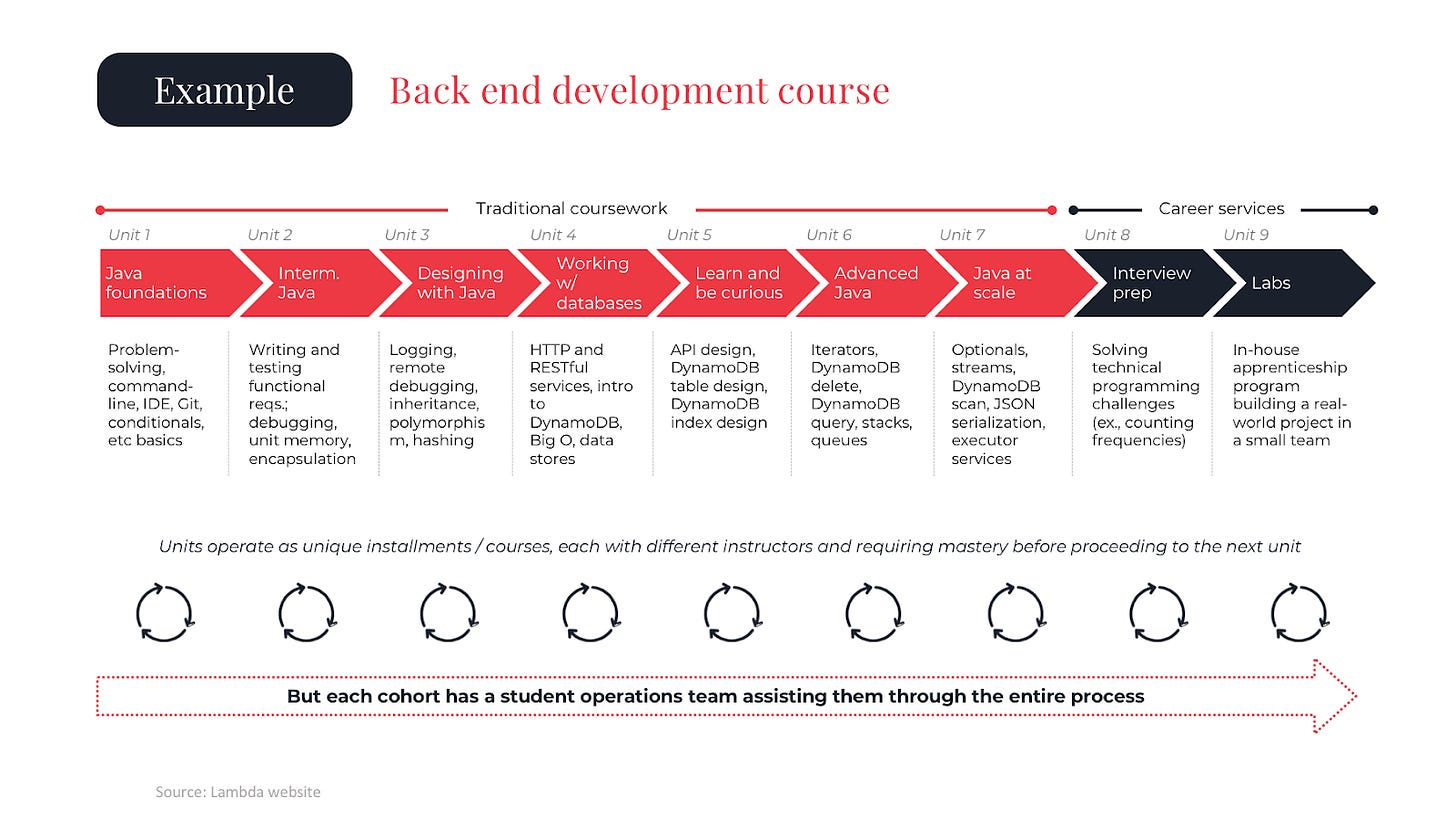

Currently, Lambda offers three programs: 1) Data science (6 months), 2) full stack web development (6 months), and 3) Backend development (9 months). Students join a cohort, and in less than a year, they progress through sequential units, ranging from hard skills (e.g., technical) and soft skills (e.g., interviewing). An example curriculum can be found in Exhibit 7.

Exhibit 7: Back end development curriculum

Along each step, students are expected to master the skills. If they do not, then the Lambda Flex Program allows them to retake a unit, free of charge. Ultimately, the program ends with workforce preparation, and payment does not begin until a student lands a job.

This unique model is fundamentally disrupting the way we traditionally think about education, and they are able to do it because of how they redefine the three challenges traditional institutions face: investment, institution, and incentives.

Exhibit 8: Lambda’s answer to traditional challenges

First, let’s discuss how Lambda School redefines investment. Within investment, consider three main (non-exhaustive) expenses:

Cost of tuition

Opportunity cost

Interest expense

Exhibit 9: Comparing total investment costs of colleges

Exhibit 9 compares the total investment required for Lambda vs. a 2-year or 4-year traditional program. People often only consider the cost of college, but the opportunity cost can be just as critical. Spending four years in college means foregoing the chance to make money for four years.

Exhibit 10: Lifetime earnings estimate

Exhibit 10 shows that Lambda students gain an early lead in earnings, and traditional students never fully catch up. While traditional students are still in school, Lambda students have already begun their careers and paid off debt. By year 14, Lambda students will have ~$500K in greater earnings than their counterparts.

The immediate counter-argument would likely be the quality of education. Here is where Lambda can remove institutional constraints and be more agile.

People often view Lambda and think the income sharing agreement (ISA) is the “secret sauce.” In reality, the X factor for them is their vertical integration. The entire school, from admissions to teachers to business development, is in sync with the primary focus of producing student value. This allows the school to quickly pivot to market demands. A primary example is the backend development course that Lambda was able to build with Amazon. Based on huge market demand, Lambda pivoted and curated a curriculum that would help get students to high-paying, high-demand job areas.

Exhibit 11: Amazon and Lambda collaboration (Source)

Exhibit 11 shows Allred directly speaking to this. His Twitter feed is filled with these examples. This is the future of education. Identify market opportunities for students. Build a curriculum to develop their skills. Establish partnerships with hirers for job placement.

The most recent example would be their Blockchain program. With the recent explosion of cryptocurrency, Lambda School has already pivoted and begun building an entire program to address the crypto skills gap. Chris Dixon and Shaun Maguire both applauded how big of a development this is. How long would it take most colleges to do this?

Traditional schools build curriculums based on what they think you should know. Lambda builds curriculums based on what the job market actually wants you to know.

There is a huge difference, and it is challenging.

I would be remiss if I did not acknowledge that students have complained about Lambda School in the past, and Allred has spent time discussing the ever-changing nature of the program. In just four years, Lambda has scaled to thousands of students while constantly iterating on the curriculum. By and large, they have been incredibly successful and changed thousands of lives. There have, however, been students challenging the value proposition, but that is ok. Allred is constantly sourcing feedback on Twitter, and with a vertically integrated, agile company, they are able to keep adjusting and optimizing long-term – something a traditional institution cannot do quickly.

Much of this focus, however, is a direct result of their monetization methods: the income sharing agreement (ISA). The ISA allows for students to postpone any college payments until after graduation and job placement. Basically, you do not pay Lambda until you get a job. The equation is simple:

Exhibit 12: Identifying the key levers of Lambda income

For Lambda, there are a few levers they can pull to drive income:

Increase the total number of graduates by A) admitting more students, B) improving student success rates, or C) both.

Improve job placement

Increase profit per student

#1 encourages Lambda to scale while still focusing on student wellness. #2 incentivizes Lambda to drive positive student outcomes. #3 forces Lambda to do it efficiently, maximizing efficiency and the student value proposition

Conclusion

A large portion of traditional secondary education construct is unaffordable, inefficient, and ineffective. As a result, we a young workforce highly underemployed, under-equipped, and oversaturated with debt. Lambda School is challenging the basic assumptions we have made about secondary education, and it is resonating.

Personally, I believe Lambda will be incredibly successful, but independent of Lambda’s success, I think there are two secondary effects that every reader should be excited about:

Challenging traditional education

Addressing the talent gap

Lambda’s innovation is disrupting traditional models, and as they gain more share, their methods will apply pressure to traditional schools to reduce costs, streamline and improve legacy curriculums, and improve student outcomes.

Second, Lambda is a critical cog in the effort to reskilling America. Automation is wiping out jobs in many places. The United States is constantly searching internationally for technical talent. Lambda (and models similar to them) provides an agile solution to quickly help displaced Americans fill these roles.

Appendix

One-pager

Exhibit 13: One page summary

Investment score

Exhibit 14: Investment score

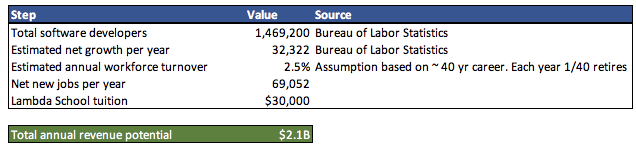

Market sizing

Exhibit 15: Market sizing

For sizing the opportunity, I looked solely at the net new jobs within the software developer market annually. There are two alternative methods that would push this market opportunity much higher:

Look at all STEM fields

Alternative high demand, low supply fields like nursing

~$155k new nurses graduate per year

Assume ~70-75% get hired

$30k per hired student

Market opportunity of ~$3.5B

Both #1 and #2 assume graduation rates stay similar, but an opportunity like Lambda would actually expand these numbers, as people transition within careers.

Regardless, both are significant developments of new courses, and they would be deviations from Lambda’s core skill set. For that reason, I take the software developer market as the base, and I range upwards based on expansion. Net: $2-5B

Competitive landscape

At the highest level, I break it down into three four groups:

Direct competitors - companies following nearly identical models to Lambda School. The primary competitor here would be Springboard

Coding bootcamps - Shorter, less-exhaustive programs. These seem to be more pay-to-play, meaning they will take you in if you pay, but the level of depth, etc. is not guaranteed. It is primarily a function of these being shorter “bootcamps” rather than full educational programs. Experiences range widely. There are many competitors. Top ones include: Thinkful, Flatiron School, and Nucamp

Massive Online Open Courses (MOOCs) and Cohort-based courses (CBCs) - these are grouped because of their one off nature. I think of most of these one-off skill development (e.g., financial modeling, copywriting, graphic design). MOOCs would be on-demand content (e.g., Udemy), but CBCs would typically be live, paced courses (e.g., Maven). MOOCs would be the more common version, but CBCs are a great, community-based way to learn that is expanding

Traditional education - Finally, we have the traditional secondary education. This includes any junior college, four-year college, or university.