Every day, founders & operators everywhere are building new technologies and companies that should us optimistic about tomorrow. My goal: champion some of these founders, companies, and industry trends. Join thousands of investors, operators, and founders on the mailing list!!

Exhibit 1: The Pipe.com one-pager

Venture capitalists pride themselves on finding disruptive technologies, but are they willing to disrupt themselves? Two months ago, a large group of VCs funded a recurring revenue marketplace that has the potential to disrupt their entire model. Enter Pipe.com.

High-growth businesses typically leverage venture capital to scale rapidly. Seed, Angel, Series A, Series B, etc. The company achieves new milestones and valuations, until they land a massive exit (via IPO or acquisition) that allows for people to cash out and investors to add to their Twitter bios.

The system has worked. Over the past 30-40 years, venture capital has enabled the rapid scaling of legendary companies.

In each raise, however, the founders exchange company equity for capital. The exchange of equity leads to “dilution”, reducing the percentage of equity held by founders and employees. This is how someone like Tony Xu (co-founder) ends up with only ~5% of DoorDash at IPO (still worth +$1B). In worse cases, the equity dilution can result in a founder losing control of their company.

The founder is constantly balancing the tradeoff of growth upside and the downside of equity dilution and reduced power.

Pipe.com removes that tradeoff by providing a platform for businesses to sell future recurring revenue in exchange for immediate capital without any equity implications.

While venture capital will continue to play a prominent role in startup growth, Pipe.com provides founders with an alternate option, drastically increasing their leverage and disrupting the traditional model.

The Problem: Equity Dilution

Exhibit 2: The traditional venture capital funding path

A traditional funding path for high-growth startups follows the steps displayed in Exhibit 2. For simplicity, I have assumed each round will be a ~20% investment. In each round, the founders and employees have their equity diluted 20%. Depending on the term sheets, dilution rights, etc., this can be quite significant.

By simply replacing a Series C with Pipe.com, the company can retain ~6% of founder equity and 3% of employee equity.

Exhibit 3: Equity dilution through Series E in traditional path

If you extrapolate further and think that the company could use Pipe.com for all funding post-Series B, then they could save up to half of their equity.

The Opportunity: Trading Recurring Revenue

The question is, however, could they fund their growth without venture capital money?

There are three main characteristics that make this both possible and necessary:

Predictable revenue - provides the ability to forecast future cash flows, mitigating risks in financing.

High costs of customer acquisition (CAC) - are a limiting factor of SaaS growth, requiring large up front funding to remove growth constraints.

High margins - drive large cash flows on incremental acquired customers.

Exhibit 4: OpenView SaaS Benchmarks (Source)

Exhibit 4 shows the average benchmarks for SaaS IPOs in 2018, 2019, & 2020. A few key takeaways:

Average IPO (late stage) SaaS companies are growing at +50%

The average gross margin is ~75%

Net Dollar Retention Rate is 120%;this means that each individual customer is expanding their product usage and payments by ~20% at the end of each contract; This means ~20% of organic growth

CAC payback is 18.5 months, signifying that ~18.5 months of monthly revenue is required to break even on the costs of customer acquisition

TL;DR: Quality SaaS products are high growth, very profitable, and very sticky (high retention).

These companies are often limited by the CAC, so they need capital. Their predictability provides high-quality cash flows.

The Solution: The Nasdaq of Recurring Revenue

Pipe.com ties directly to a company’s financial platforms, and based on the predictability of the cash flows, it will price contracts and allow companies to sell recurring revenue for capital.

In Chamath Palihapitiya’s investment one-pager on Pipe, he mentioned the company’s monthly recurring revenue (MRR) is trading at $0.90-0.95 of par value.

Example: Company PMF (product market fit) wants to sell 12 months of $100K MRR.

PMF lists their contracts, and an investor (let’s call him Jason) purchases the contract. This investor likely did not get any equity in early Pipe.com rounds, but they still want to participate and feel like they are “part of the party.”

Exhibit 5: The cash flow exchange of Pipe.com

Exhibit 5 shows the cash flows from both the company’s perspective and the investor’s perspective.

PMF receives $1.1M from the Jason on Pipe.com to invest in customer acquisition immediately. In return, they pass $100K of MRR to Jason for the next 12 months.

Jason “purchases” this MRR by giving the PMF $1.1M. In return, Jason will receive $100K per month for the next 12 months ($1.2M). This is a ~9% return.

Jason clearly makes a 9% return, but does it make sense for the PMF?

If PMF can use those funds to acquire new customers and accelerate growth, then yes.

If we take the company PMF example further, we can look at how their revenue recognition would vary based on duration (e.g., how long the contract they sell is) and increased growth.

Let’s assume that PMF was growing at ~20%, and they have a $100K MRR three-year contract they are considering selling.

Exhibit 6: Pipe.com transaction pay period over time

Exhibit 6 shows the total recognized revenue of company PMF based on both incremental growth and duration. The 20% line represents the company’s baseline growth assuming they do nothing.

These curves are very simplified, and they only assume incremental growth on the $100K of business sold.

Key takeaways:

Company PMF recognizes large capital infusion (from Jason) at month 0

If the capital infusion provides >5% of incremental growth, then the Pipe.com transaction curves never pass below the baseline on total recognized revenue

If PMF can sell a 36-month, $100K MRR contract and accelerate growth from 20% to 40%, then they can recognize almost $7M more of recognized revenue than baselines (~$5M), for a ~$2M gain

Exhibit 7: Pipe.com transaction based on growth

Exhibit 7 shows the curves based on overall growth rate increase. As with exhibit 6, these curves are very simplified to be a consistent, compounding growth. In practice there are mainly complexities, but the primary takeaway is understanding that the incremental growth rate is the primary driver of value in the Pipe.com transaction.

Net: If PMF can pull forward capital of contracts at $0.90 of par value and leverage it to drive incremental growth, then the transaction will pay off rapidly. All without any equity dilution.

If PMF cannot effectively allocate the funds for growth, then the net impact will be marginal.

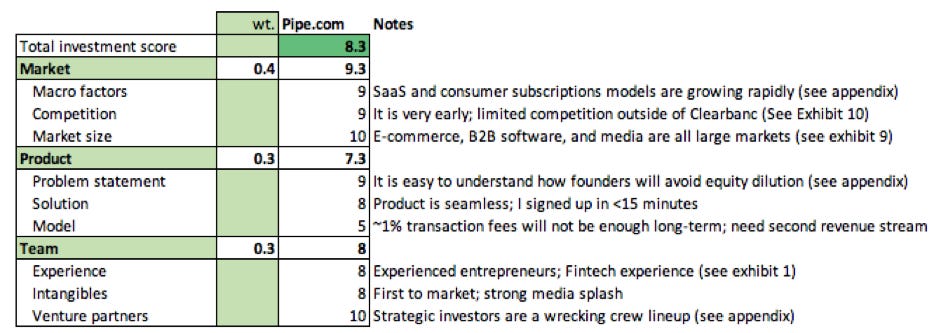

Investment score

On the extremely-scientific-no-possible-gaps Jeff Burke scale, I give Pipe.com an 8.3.

Exhibit 8: Investment score breakdown

Pipe.com knocks it out of the park in the market factors (see appendix). Large market (see exhibit 9). Expanding rapidly. First mover in their space (see exhibit 10).

The only question to me is on the business model. 1-2% transaction fees are still material in such a large market, but as with other brokerages, the fees tend to migrate to ~0% long-term as competition increases. I think Pipe.com will need to establish a second revenue stream. Options could include additional finance products (e.g., directly offer credit lines since they have financial platform visibility) or data mining.

Conclusion

The economics of using Pipe.com for recurring business models is clear. SaaS is the most obvious application, but there are many creators (e.g., Substack subscriptions) and e-commerce (e.g., Shopify-based monthly packages) that will leverage this for significant growth. As David Sacks (aka King of SaaS, David SaaScks) said about Pipe, the idea was so obvious that he had a term sheet within 15 minutes!

The idea is brilliant. The economics make sense. The final consideration: execution.

The Pipe.com founders, Harry Hurst, Josh Mangel, and Zain Allarkhia, are all serial and seasoned entrepreneurs. In just two years:

Built a team of 25+ (including Fintech experience from Plaid, Stripe, and Brex)

3,000+ customers

$1.0B+ liquidity on platform

100%+ MoM growth

On top of that, they have constructed a platform that connects to business financial tools in <15 minutes, providing a real-time view of contracts. Businesses can sign up quickly, and they can sell contracts with agility, providing real-time financing for their company.

Finally, they have raised $50M+ and acquired strategic investors across the landscape, positioning Pipe.com for a swift strike at disrupting growth stage fundraising.

Appendix: Battlecard Backups

Problem Statement

Pipe solves both an operational and financial issue for high-growth SaaS companies.

Operationally, SaaS business growth can be limited by capital constraints and the Customer Acquisition Cost (CAC). After acquisition, the monthly recurring revenue (MRR) is predictable and pays back in ~18-30 months. If they want to receive upfront payment, it usually requires a significant level of discounting to the customer (~30-40%).

Financially, the company can remove the capital constraint by A) raising debt or B) raise venture funding. The former can further constrain cash flow. The latter dilutes founder and employee equity.

Pipe.com gives SaaS companies the chance to finance their high-growth company with non-dilutive financing by converting their MRR into an upfront cash payment.

Growth drivers

Subscription business models – Extensive growth in both business-to-business (B2B) and business-to-consumer (B2C) business models will expand the market for Pipe.com

a. B2B - Analysis from Deutsche Bank estimates the SaaS category has grown 11X in market capitalization. The total share of SaaS within the software market has grown from 2% to 14%. They estimate the SaaS category to grow to ~$600 billion by 2020. Overall, businesses even as large Cisco embrace subscription models. Gartner estimates all new market entrants, as well as 80% of historical players offer subscription-based business models

b. B2C – 34% of Americans believe they will be using more subscriptions in two years. The average number of subscriptions has grown from 2.4 to 3. Increasingly, Americans are using products like streaming, publications, apps, etc. that require subscription based fees

2. Creator economies - This is heavily dependent on b. Increasingly, platforms like Substack, OnlyFans, and Shopify are creating platforms that enable creators to place value behind paywalls. Newsletters or e-commerce subscriptions are just two examples of how individuals can instantly stand up recurring revenue streams. The unbundling of media will both A) increase the numbers of creators and B) increase the difficulty of requiring off ad velocity (cost-per-mille), requiring different models (like subscription)

Uncertain factors

1.Interest rates – Historically low interest rates offer both a positive and negative factor to growth. If I had to guess, it will directionally help Pipe.com

a. Low cost of debt – Interest expenses on debt are rigid, and the effects on monthly cash flow often make debt taboo for high-growth companies. Historically low rates, however, will likely cause more companies or individuals to go the debt route than traditional. It is both non-dilutive and relatively cheap

b. Low return for investors – On the other side of the equation, however, low rates lead to investors looking for alternative places to invest capital. Traditional fixed incomeassets like bonds are earning historically low returns. Investors will look to alternative methods (like PIPE) to invest capital into an asset with a fixed return.

Challenges

1. VC growth expectations –

a. Growth rates - Pipe.com offers agile financing leveraging MRR, but it only pulls money from future revenue forward. The upfront payment from Pipe comes at the cost of future cash flow. It does not inject purely incremental funds into the company. As a result, it will provide agile funding, and it will avoid diluting founders and employees, but in theory, it will not enable as much growth as a series of funding would. Early investors have growth targets and timelines, so they will challenge using pipe exclusively for future financing

b. Politics – There are both political downsides and upsides to raising from venture capitalists. For the positives, look no further than Pipe’s raising. They strategically included Alexis Ohanian, Chamath Palihapitiya, Marc Benioff, Michael Dell, David Sacks, Okta, Slack, Shopify, and others as investors. In short, strategic investors can provide publicity, as well as personal connections, to drive significant value for high-growth companies.

On the downside, giving equity away can cause political challenges such as pressure to raise another round (and further dilute), board seats, etc.

How big is the market?

Exhibit 9: Pipe.com market sizing and revenue potential

B2B – SaaS

Estimated ~$600B of total SaaS market by 2020 (Source)

Estimated public cloud services market of ~$305B in 2021, growing at 18%(Source)

Assume total SaaS market size and use public cloud growth rate as a proxy

Pipe.com takes ~1-2% transaction fee

Estimated ~$6-12B in est. revenue potential at 18% growth rate

B2C

Bottom-up for United States for all non-media

Americans spent ~$640 on digital subscriptions in 2019 (Source)

$170 per year spent on streaming services

Estimated non-TV wallet share of $470 per year

Growing at ~7%

~$540 in qualified spend in 2021

~123M American households; assume ~120-160M qualified wallets

~$65-86B estimated American digital subscription serviceable (TAM of ~$88-117B)

Pipe.com takes ~1-2% transaction fee

$0.7-1.7B in est. revenue potential at +50%(Source) in 2021

(Alternate option) E-commerce subscription

$478B by 2025, growing at 68% CAGR globally (Source)

Estimated TAM of ~$60B in 2021

OTT video ~$37B in 2021 (Source)

Assumption: Traditional OTT spend from large established players (e.g., Netflix, Disney+) is not addressable for Pipe.com

Estimated ~$23B in 2021 e-commerce subscription market serviceable by Pipe, growing at +50%

Pipe.com takes ~1-2% transaction fee

$0.2-0.4B in est. revenue potential at +50% in 2021

Note: Excluded from total; Included as sub-set of Bottom-up

Competition

Exhibit 10: Pipe.com competitive landscape

There are really three groups of competitors for Pipe.com:

Venture Capitalists – VC’s are not mutually exclusive of Pipe.com; someone could use Pipe.com AND raise venture funds to double their capital, but Pipe.com does stand to pressure and conflict with traditional VC funding efforts

Debt / Traditional financial institutions – Traditional FI’s offer commercial loans; these loans can be highly complex, and the interest payments can heavily reduce the cash flow of a high-growth business

Direct Pipe competitors – there is limited competition at this point; there are no real formidable players building the platform Pipe.com is, but there is a strong Fintech competitor in Clearbanc (also funded by Chamath)

Hi Jeff,

Any idea of what would happen if a company on Pipe's platform would be in a liquidity crisis situation / possibly default on their loans? Would the investors on the platform take the loss, or start going after the company's assets?

Great Article.