Every day, founders & operators everywhere are building new technologies and companies that should us optimistic about tomorrow. My goal: champion some of these founders, companies, and industry trends. Join thousands of investors, operators, and founders on the mailing list!!

The Context: Our current consumption is unsustainable

Humans generate a lot of waste. An unsustainable amount. Every year, scientists, activists, organizations, etc. pour money into trying to educate people on the hazards of our habits, but sadly, most people just don't seem to care.

Documentaries. News articles. Viral posts. All of these show the harrowing effects of our consumption like the Great Pacific Garbage Patch.

Note: I vote we rebrand this to the “Not so Great Pacific Garbage Patch.”

Despite all of these efforts, it is still estimated >1M tonnes of plastic enters the ocean every year… That’s 3x more plastic than the weight of the entire Empire State Building.

One of the obvious solutions is improving recycling, but before we do, I think we should get a high-level view of the current state from three different perspectives:

The global perspective

The US perspective

The forward perspective

The global perspective

First, let’s look at waste generation globally.

Most notably, we can see where waste consumption is projected to grow rapidly: the emerging economies. It makes sense. As these economies build, their waste levels (on a per capita basis) would presumably continue to migrate to North America's. Given their larger populations, it is no surprise the scale of potential waste.

Countries, however, are highly variable in how they handle this waste.

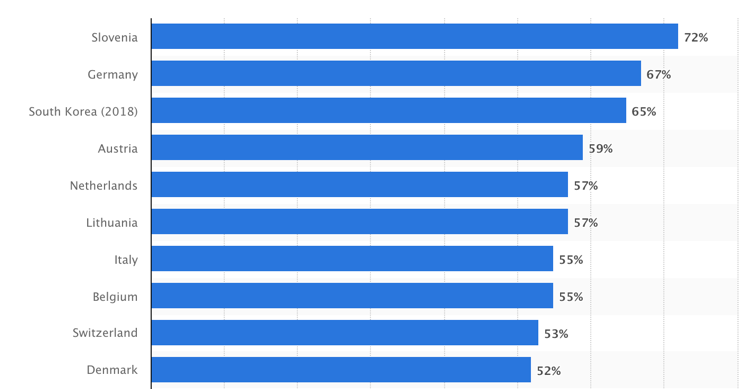

For example, Exhibit 3 shows the top 10 countries based on solid waste recycling rates. 9 of the top 10 are in Europe. The drop off, however, is pretty sharp. By these estimates, the United States lands at 24th with a recycling rate of ~34%.

Where we do have data, some estimates have emerging Africa and South American countries recycling at rates <10%.

In short, the global takeaways are:

The scale of waste generation is increasing globally, particularly in emerging economies like APAC and Africa

Waste Management & Recycling is highly variable by region, with Europe leading the charge

Recycling rates appear to be particularly low in scaling emerging economies

Emerging hypothesis: The recycling policy & sustainability culture varies significantly by country. In areas where less priority is placed on recycling, there is no financial incentive to recycle & manage waste at high rates (beyond highest value materials)

The US perspective

As mentioned above, the United States ranks 24th in recycling with a rate much lower than leaders like Slovenia and Germany.

Luckily, the EPA provides a wealth on data for the US, so using a couple of quick views, we can generate some hypotheses on trends and causes.

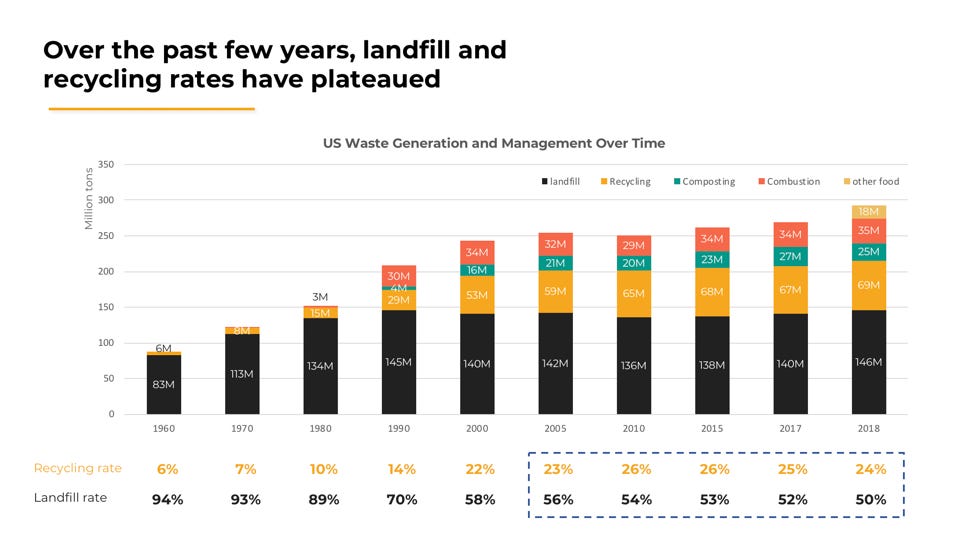

First, we can look at overall US waste generation. A few key takeaways:

Overall waste generation is moderately increasing (~3%)

~50% of all waste ends up in a landfill, declining slightly YoY

Recycling and Composting rates improved in the 90’s and early 2000s, but they have largely plateaued at ~30-35%

So why has the recycling rate plateaued? Are we recycling everything we can? No. Some estimates say that ~80% of what ends up in a landfill could be recycled.

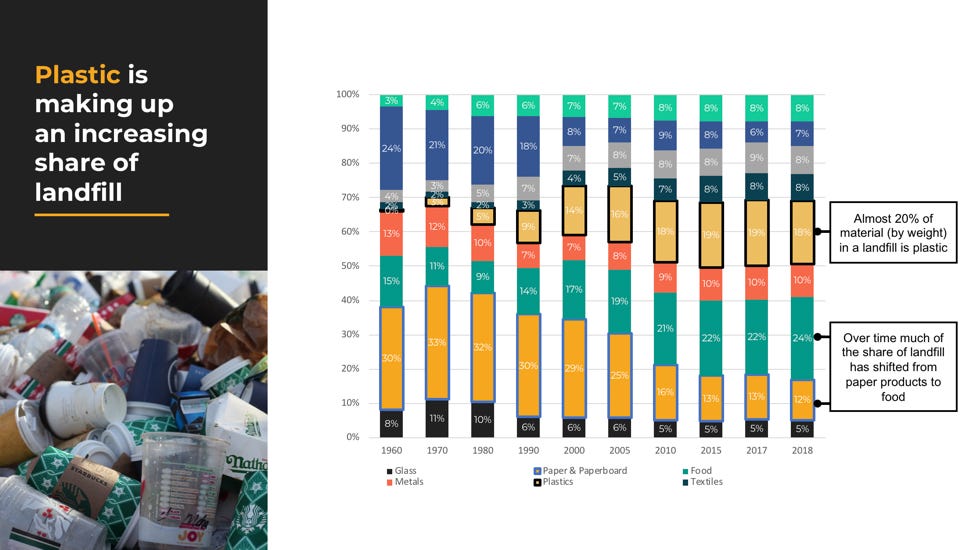

If we look at what the EPA says ends up in our landfills, we can see there have been large increases in food & plastics. Roughly 36M tons of plastic enters landfills every year, and it is increasing.

Plastic, however, is largely recyclable and reusable. There is value in it. This is a problem that needs to be (and will be) solved.

Emerging hypothesis: Plastic presumably has some of the highest value, but it continues to be landfilled. Sorting & recycling plastic is likely too challenging given the complexity.

The forward perspective

And people have been trying to solve it. Over the past few years, not only have there been many activists, policies, etc., but social activism is finally applying pressure to corporations.

Over 250 organizations, including Johnson & Johnson, Coca-Cola, PepsiCo, and others, are making pledges to reduce plastic waste. This is critical because it is developing a stronger market for recycled plastics. Where there is profit, people will invest.

Although recent, it has so far not dramatically impacted the amount of plastic entering landfills? As we update the data, we will hopefully see an improvement, but early indicators suggest we might not.

As a matter of fact, these companies are struggling to meet their pledges because they cannot find enough recycled plastic. There is a supply crunch. Even with premiums, we have not seen the market be able to provide enough plastic.

Emerging hypothesis: The increase in renewable plastic demand is not being met with supply because either:

A) the market still needs time to invest and meet demand

B) sorting plastic is primary a problem of cost-drivers and is still unprofitable

C) a mixture of both

To summarize:

Global perspective: Humans generate a lot of waste, and it is increasing, particularly in emerging countries. Some countries are exceptional at waste management, but many of them (the US included) are lagging.

The US perspective: While we have improved over the past 20-30 years, our overall recycling rates and landfill rates have plateaued. Roughly half of our waste is being landfilled, and an increasing share has been from plastic

The forward perspective: But there is a market for plastic. Organizations have identified the pollution crisis, and they want to use recycled plastic… but we keep throwing it away.

The Problem: Our Recycling Process Is Broken

So why would we be placing 36M tons of plastic into a landfill when companies want to buy it? Put simply, our current process is broken.

To best understand the problem, let’s discuss:

The challenges – the limiting factors

The unit economics – recycling as a business

Let's walk through three categories of challenges (non-exhaustive):

Endemic – foundational issues outside of the facility’s control

Operational – Challenges within the sorting facility’s process

Output – Challenges with final product

Endemic challenges

First, let’s discuss the endemic challenges. These are largely outside the control of the sorting facility. For this reason, it is unlikely the facility can problem solve too much here, but they do need to manage them the best they can.

For example, there is a lot of complexity around the materials that come into the sorting facility.

Just think of a grocery store shelf (Exhibit 7). Yogurt cups. Plastic milk jugs. Paper milk jugs. Different types of plastic.

Then consider the entire store. Newspapers. Cereal boxes.

In the end, all of these show up crumpled, messy, and relatively unsorted. And this is just within food related products. This does not include product packaging, etc.

In summary, it is extremely complicated and complex. There is no way around that. Consumers (us!) are terrible at sorting it themselves, so we have to rely on these facilities.

Second, each recycling facility operates under different policy. There are local, regional, and global policies, and they impact both the complexity, as well as the unit economics (to be discussed in the next section). Recycling facilities and activists can push for favorable policy, but largely, this is outside of the facility’s control.

Endemic challenges are foundational challenges that simply have to be managed. Their job is complicated and challenging.

Operational challenges

Operational challenges are the most critical bucket. They are fully within the sorting facility’s control. Here there are two challenges that are critical and solvable (foreshadowing!): safety and manual processes.

Remember when I said consumers (us!) are not good at self-sorting? Well, that was an understatement. We are TERRIBLE at it. Every sorting facility has horror stories of hazardous objects being recycled, and the facility has to manage it. Consider this plant in Aspen found a SHARK and a HAND GRENADE.

It is actually quite serious. The impact on employee safety is obvious, so why don’t we automate it?

The industry complexity has made sorting automatically nearly impossible (until this point). Mistakes in automatic assorting contaminate final product, and it can even break the machinery, further jeopardizing safety. As a result, objects are still sorted manually…

You heard it right. All of that recycling you toss in bins is manually sorted by people with gloves. And as you can imagine, this is really hard (remember the hand grenade?).

The reliance on manual sorting is the most important challenge of the entire industry.

Complex materials (mentioned earlier), long shifts, dirty and hazardous work, etc. This job is very difficult, and as a result, there are many implications:

Unsustainable workload → High employee turnover

Complex materials → low & inconsistent quality of sorting

Limitations of manual labor → Unscalable

Limited visibility → inability to identify quality of process and efficiencies

Ultimately, most of the true operational challenges stem from safety and the manual nature. Solving for this will be critical to improving recycling as a business.

Output challenges

Finally, there are challenges with output. This is the top of the pyramid for a reason. It is the most critical component of making recycling an ROI-positive business, BUT it is largely a byproduct of managing endemic challenges and solving operational challenges.

Within output challenges, there are two main considerations:

Specificity – Sorting specific types of materials

Purity – Contamination rate within the specific materials

For specificity, the question is: Can you separate and sort out the specific different types of materials (e.g., office paper vs. newspaper)?

Purity is the follow-up question: How well were you able to sort it?

This is critical to the overall economics of the business. Consider the snapshot of commodity prices above:

Office paper is ~2X more valuable than mixed paper

#2 HDPE is ~4X more valuable than #1 PET

Co-mingled plastics COST money to dispose

Basically, sorting at high quality is critical to profitability. It makes sense. But consider how hard this is given the operational challenges.

How can you sort effectively while also understanding purity levels if it is all manual? It is really, really hard. To check purity, it is actually a very costly, manual testing process.

Resolving operational issues trickles down and solves for your output challenges.

Unit economics

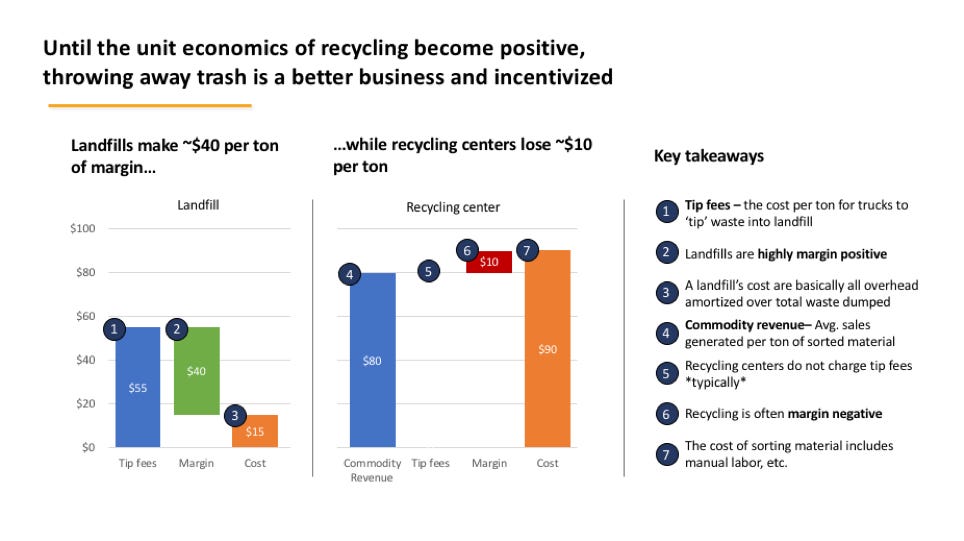

Before we discuss solutions to operational issues, let’s quickly discuss the business economics.

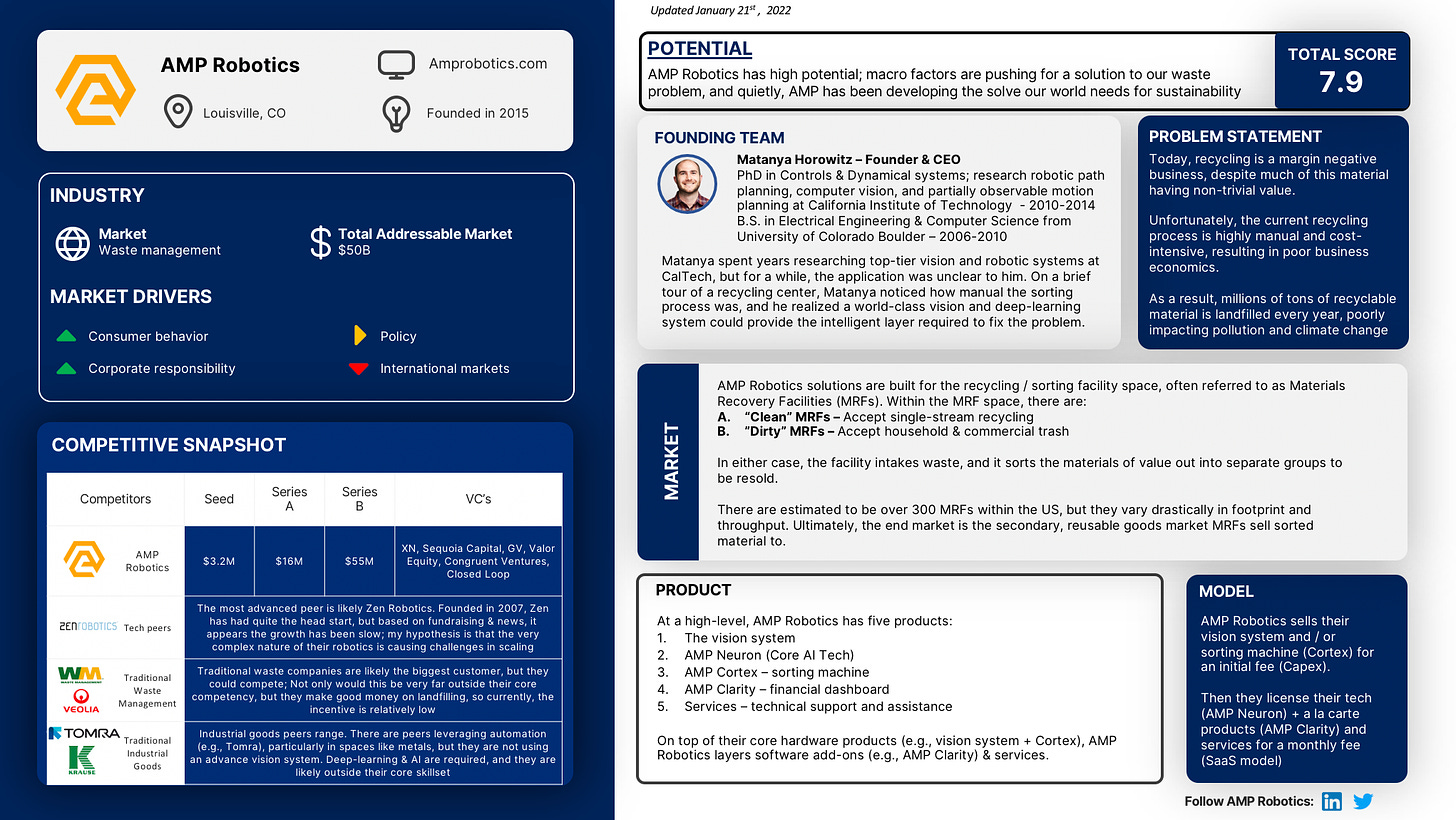

AMP Robotics founder, Matanya Horowitz, discusses the challenging economics of recycling, and it is hard to argue. Earlier, we noticed that plastic was still getting landfilled at a high rate, despite many retailers being willing to pay for it. But why?

In the early 2000s, commodity prices were higher, lifted heavily by China. In 2017, however, China invoked their 'national sword' policy. This has limited their imports of waste, and as a result, commodity prices for recyclable material declined.

Since then, recycling centers struggle to profitably sort it. In Exhibit 9, we can see the pricing is quite high, but if it is co-mingled, contaminated, etc., then it is not worth much.

Meanwhile, landfills charge a modest $55 per ton to dump trash, but their cost is very low. It is basically just the cost of land + overhead amortized. As a result, landfills can be highly profitable, and they will accept almost any material from waste management companies.

In summary, landfill is profitable. Recycling is not. Until recycling is a profitable business, there will always be market dynamics that push more material to landfills. Retailer demand for recycled material may push prices up, but the most critical lever for sorting facilities is solving their cost structure.

The Solution: Leveraging Deep-Learning Vision Systems to Make Recycling Profitable

AMP Robotics is here solve both operational and output challenges through a product suite designed with the intelligence and sophistication required to automate the industry.

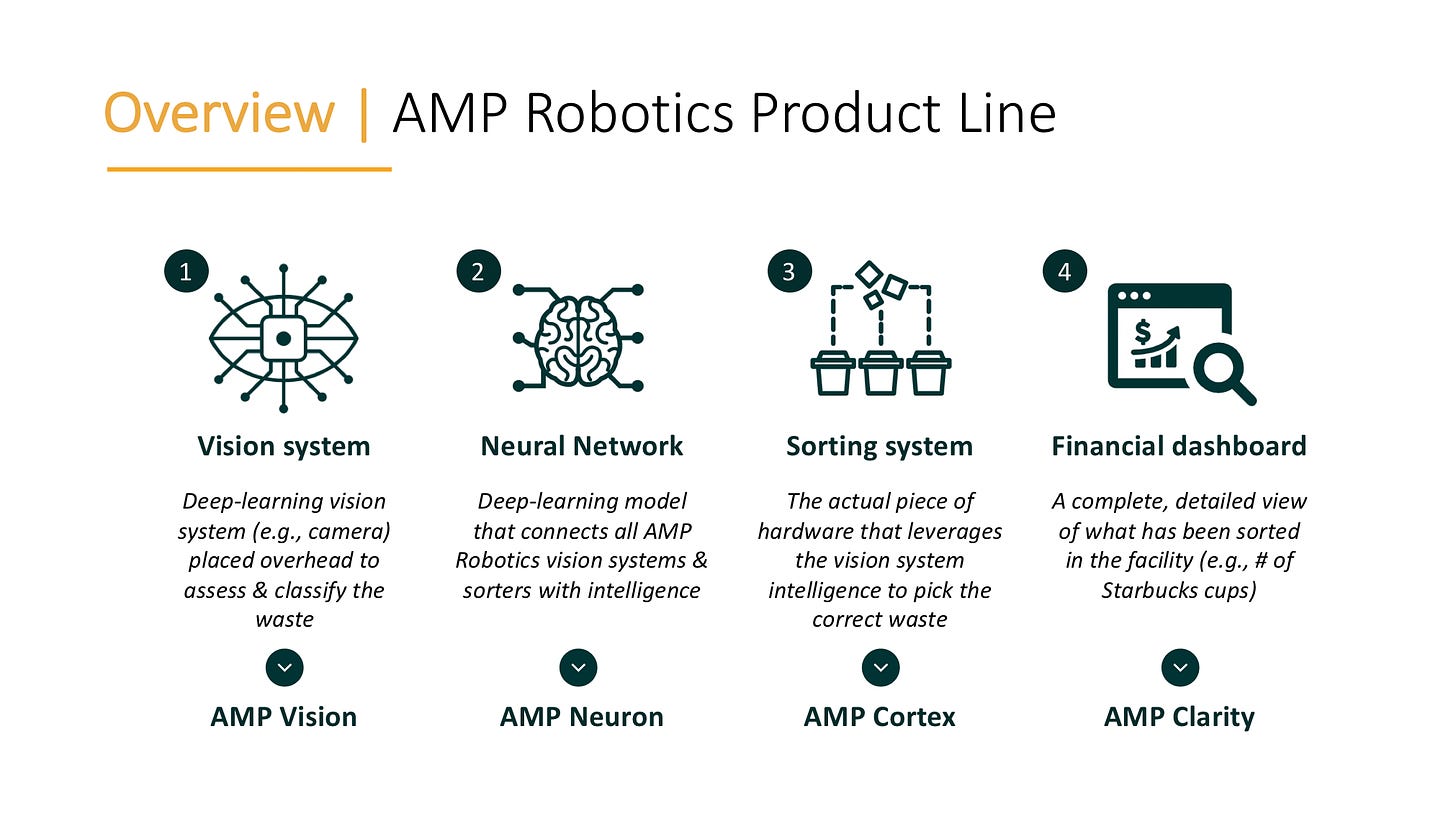

AMP Robotics solves both operational and output challenges through four products:

AMP Vision - Deep-learning vision system

AMP Neuron - AI network

AMP Cortex - Sorting robot

AMP Clarity - Financial dashboard

AMP Vision

Let's start with the vision system. In Exhibit 6, we discussed the complexity of materials. This is an endemic challenge. For example, there are:

Different categories (e.g., paper)

Different sub-categories (e.g., office paper vs. paper cups)

Different brands (e.g., Starbucks cups)

Different sizes (e.g., Venti cup)

Different alterations (e.g., Torn in half)

There are billions of permutations. So how do you handle this?

The AMP Vision system can be placed in facilities, and it classifies every object. That may be confusing. How does it learn? Like any other sophisticated model! You train it. (Note: I spoke at length about this in my Hugging Face writeup)

Let me give an overly simplified example. Think about a child learning colors. You point to things and say "red" or "blue", etc.

One day, a firetruck comes on the television. The child has never seen one before, but instantly, the child points and says "red." You say "yes!". Had the child said "purple", then you would have gently (hopefully) said, "No. That firetruck is red." Either way, the child continues to learn and refine their understanding of "red."

In this example, the child takes something they were taught (e.g., color) and applies it to something they have never seen before (e.g., the firetruck). As they progress, they will even take multiple learnings and combine them to infer.

Let's say the child sees an ambulance. It is red. Has wheels. Has sirens. The child combines these three attributes and infers the ambulance has a connection to a firetruck.

This is essentially what the vision system is doing. It sees over 10 billion materials annually, and it catalogs what they are. Plastic Gatorade bottle. Dirty Starbucks cup. In the process, the system gets REALLY good at determining unique materials, even if it has never seen that exact example before. Based on the categorization, it knows how to sort them.

Well how good can this actually be? In AMP Robotics case, it can properly identify the main commodities in a recycling bin with 99% accuracy.

AMP Neuron

All of this categorized intelligence is training the main neural network: AMP Neuron.

What does this mean? All vision & sorting systems are giving feedback back to a centralized data set that is refining the model. This accomplishes has two primary benefits:

Immediate deployment

Increases scale

First, consider you are a recycling facility deploying AMP Vision. It would be time-intensive & laborious to train that model from scratch every time. Because of AMP Neuron, you can deploy the camera, and it is immediately leveraging all of the previous training it has already done across the globe!

Second, there is a network effect by having AMP Neuron. The model improves as the data set increases. Put simply, the more items AMP sees → the better it gets. As more sorting facilities buy the cameras, the total dataset increases rapidly.

Today, AMP Neuron is processing +10B items per year across 150+ systems!!! If a new item (e.g., Gatorade launches a new bottle) pops up in a plant in Tennessee, the facility in California will be prepared to process it!

AMP Cortex

To this point, we have only discussed the intelligent layers of AMP Robotics, but there is, of course, an obvious next question: how do they act on this? AMP Cortex.

The AMP Cortex sits over the conveyer belt, and it quite literally has an arm that picks the waste based on the vision system recommendations.

With the AMP Cortex, facilities presumably do not need to rely on manual labor. As a result:

Improved safety

Higher throughput (e.g., more picks per minute)

Reduced costs (e.g., remove labor costs, turnover, etc.)

AMP Clarity

Finally, AMP provides a comprehensive dashboard: AMP Clarity. In Exhibit 6, we discussed the importance of purity and specificity. In Exhibit 9, you can clearly see how that impacts the price for which you can sell the waste.

AMP Clarity provides clear visibility into the waste you have sorted, including quality, contamination, etc.

For sorting facilities, they can have the vision system & AMP Clarity to clearly measure how well their employees are sorting. If they add AMP Cortex, they can automate the entire process.

Regardless, AMP Clarity gives a clear window into their waste. Sorting facilities gain real-time, actionable insights to A) improve operations and B) leverage in selling to secondary markets.

The Full-Stack Solution

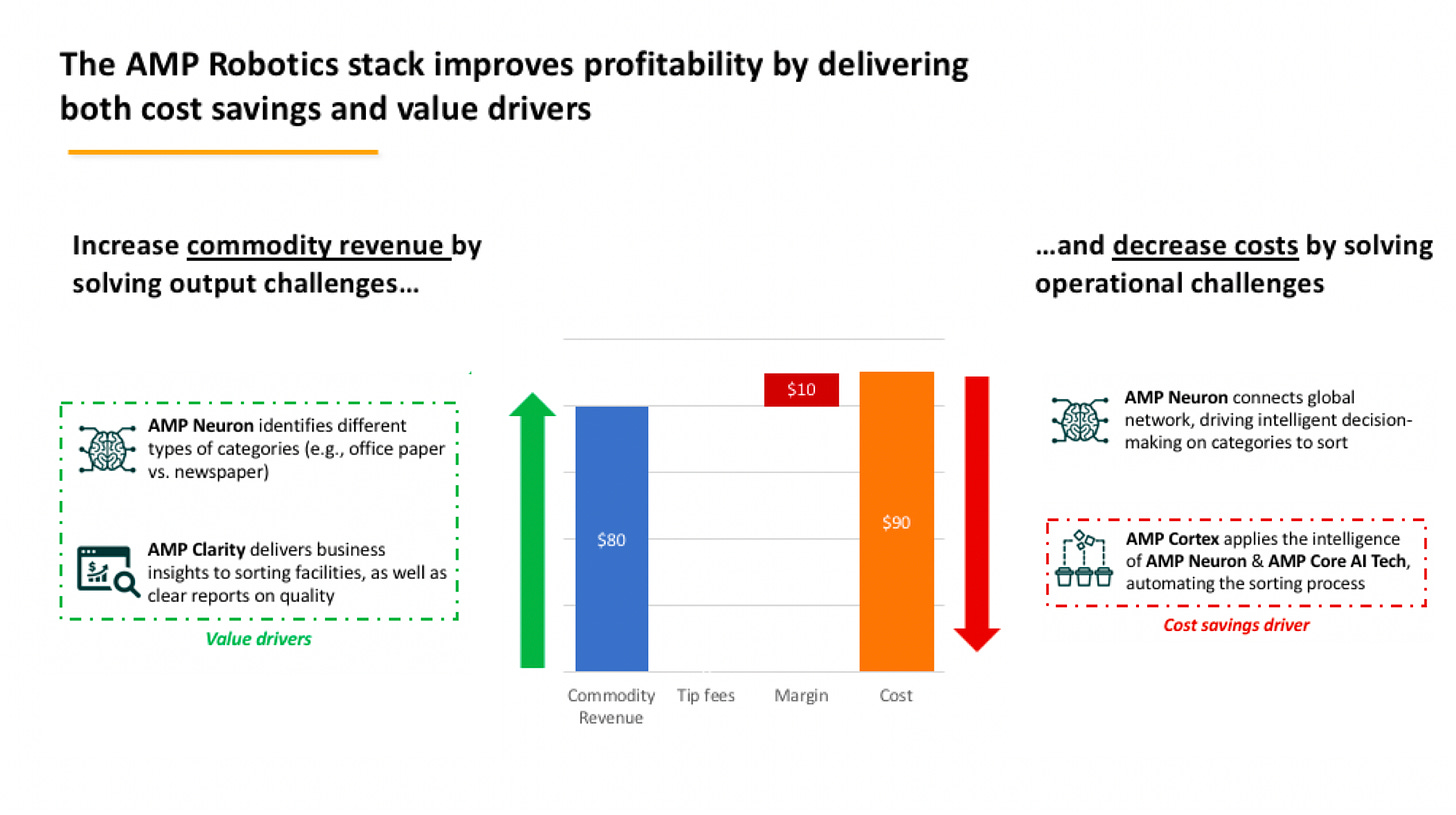

If you combine the entire solution, the story makes sense. In Exhibit 10, we discussed the poor economics and profitability of recycling. There are only two ways to improve profitability: A) increase revenue or B) decrease costs. AMP Robotics does both.

Leverage AMP Vision + Neuron + Cortex to automate sorting, solving operational challenges (safety & manual process) and reducing costs.

Then use AMP Vision + Neruon + Clarity to assess output challenges (purity & specificity), improving monetization and driving up revenue).

With the full-stack solution, there is a very clear path for recycling plants to invert the unit economics and make recycling a profitable industry.

And it is already working. With the robots, AMP Robotics already can get the cost of sorting to $65 per ton (Source: MyClimateJourney Podcast). Even without a revenue lift, that flips the margin from ~-$10 to ~+$15.

Conclusion: The Future of Recycling

By now, I hope I have sold you on the importance of AMP Robotics... but wait!!! There is more! Let's discuss four topics for the future of waste management:

Competing with landfills

The role of the public and private sector

Reclaiming waste

The futuristic vision

Competing with landfills

In Exhibit 10, we clearly see that the economics of landfills are better than recycling centers. Even with AMP Robotics, landfills operate with a much larger margin. Recycling centers, however, do have two distinct advantages:

Tip fees

Geographic location

Landfills charge waste management companies to dump the trash. Today, recycling centers often need to charge as well. Otherwise, they would be unprofitable. If recycling is made more lucrative, however, they could accept trash for free (no tip fees), and they can monetize the waste. In this scenario, waste management companies are less likely to pay to dump trash, and rather, they will drop it at recycling centers for cheap / free.

Second, landfills obviously require immense amounts of land. Recycling centers do not. As a result, recycling centers can be located much closer to metropolitan areas, further improving their unit economics to receive waste. Both of these factors could long-term help recycling become a better business than landfills.

The role of the public and private sector

AMP Robotics provides a path for sorting facilities to become profitable, but the public and private sector could give the industry a huge lift.

From a public sector perspective, the answer is obvious: policy. Examples include:

Require automated sorting and quality checks to strengthen the overall output of the industry and force transparency

Provide incentives / subsidies to reward recycling and limit sorting facility costs

Tax or penalize landfilling waste to make it more cost prohibitive than recycling

Design policy to strengthen recycled materials markets

From a private sector perspective, a continued demand from companies and consumers for reused plastic will be critical. As we mentioned earlier, many companies are pushing for these materials and paying a premium will lift commodity revenue and improve sorting facility economics.

Reclaiming waste

Finally, if recycling becomes more profitable, there becomes a world where it makes financial sense to reclaim trash vs. just manage existing trash. What does this mean?

Right now, we are focused on processing trash that has recently been thrown out. But if you can make significant money selling reused plastic, would it make financial sense to go gather plastic from the Great Pacific Garbage Patch? What about dig up trash from landfills or pick it from the side of the road? Maybe.

It is hard to see this make economic sense without significant public sector help, but it is a possibility. Where there are profits, investment will go.

At its core, that is why AMP Robotics is so critically important. Similar to Tesla with EV's, Solugen with renewable chemicals, and many others, AMP Robotics is making change by redefining the playing ground. That is the level of innovation and problem-solving that makes serious impact!

The futuristic vision

Combine all of these, and you end in a beautiful futuristic vision where 90% of what humans consume is reused. With AMP Robotics, there is a future where sorting is fully automated. As a result, facilities are smaller and centrally located to high-waste areas (e.g., metropolitan areas) and less dense areas (e.g., suburbs), so 90% of consumed material is efficiently, rapidly, and safely sorted.

In an ideal world, we will not only reduce waste to landfills by +90%, but there will be a path to profitably reclaim waste from the environment and begin cleaning our planet!

Appendix

One pager

Investment score

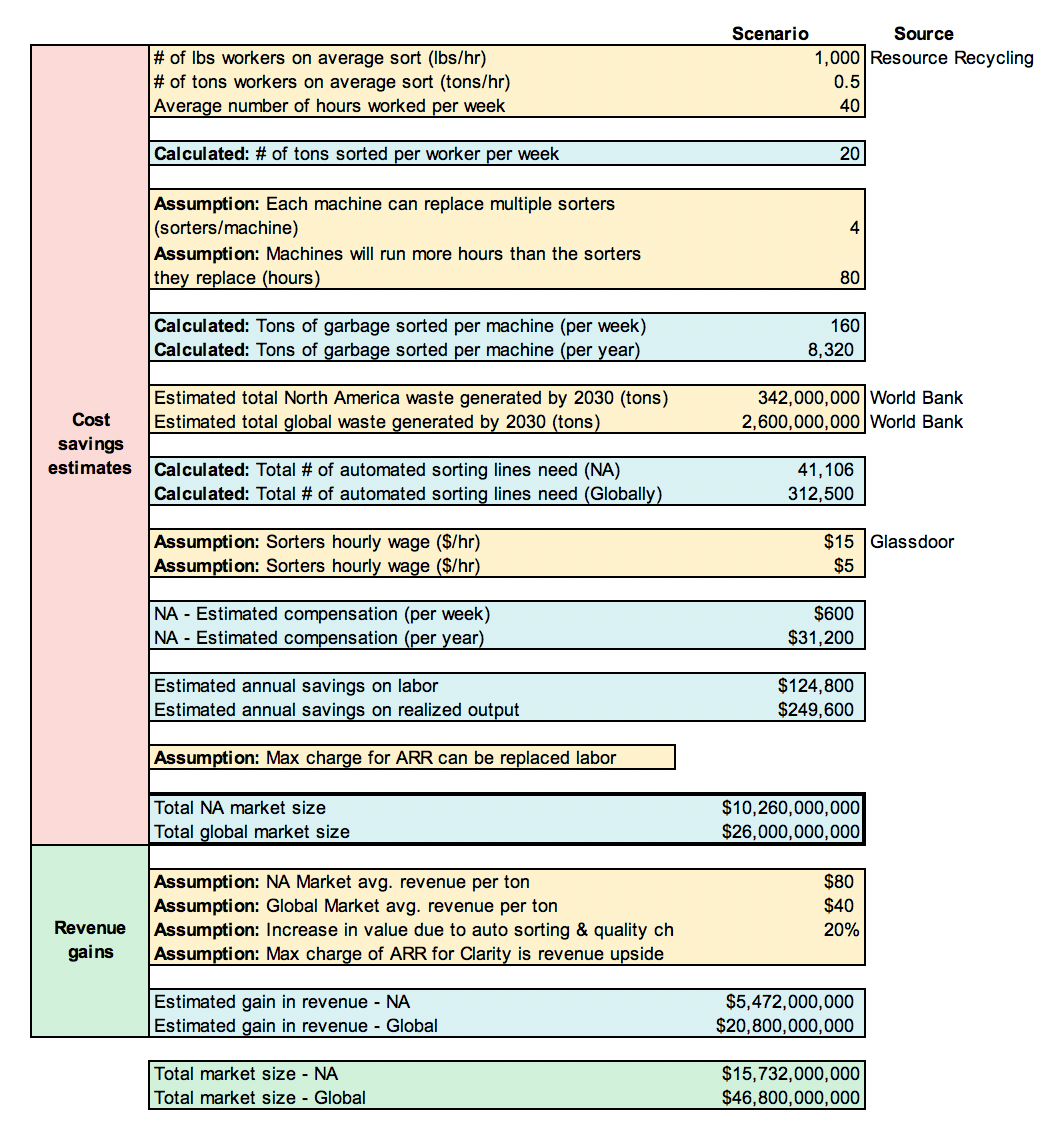

Market sizing

For the market sizing, I did a bottom-up to define the the market (as it sits today).

The logic: If AMP Robotics makes recycling profitable, then we will sort 100% of trash (in theory). We can estimate market size / willingness to pay by understanding the top-end of sorting costs (e.g., Labor). In summary, sorting facilities would never pay more for AMP than they would for labor.

Assumptions that could overstate the market:

If recycling is profitable, we assume they will sort 100% of the market as top bound

We assume a blended hourly rate of $15; internationally, it is likely lower, overstating the global market

We assume they pay the equal amount to labor costs, but likely (for recycling to be profitable), they would need to pay much less

Assumptions that could understate the market:

This only accounts for sorting costs; excluded costs that AMP Robotics solves for include: quality checks (solved by Clarity), turnover (e.g., cost of hiring, benefits), opportunity cost (e.g., slower sorting, missed shifts by workers), financial management (e.g., staff devoted to tracking sorting & economics), services, and current sorting machinery Capex

This only accounts for cost impact, but willingness to pay would include revenue lifts (e.g., using Cortex, Clarity + Vision, you can boost revenue), and it does not forecast significant lifts in demand YoY

This assumes a max run rate of ~80 hrs. In theory, if automated, the machines could run much more

Overall, I think the US market is likely slightly understated, and the global market is slightly overstated.