unspun: localizing the global apparel supply chain

Startup spotlight #13

Note: There has been a long delay between the posts. Turns out building a startup is… hard!!! But I have still been writing, and I will have more to share. Today, I am excited to share unspun. unspun is one I am particularly excited about. Full disclosure, I have invested in unspun. They are one of my first investment checks! Their team is incredibly strong. Their mission is important. Their solution is innovative. And they can win in multiple ways. I am excited to share!

If you are like everyone else, you likely began your day with the same decision most people do: What should I wear?

Clothes are an intimate part of our life. Weddings. First dates. Mondays at work. A day at the park. We use clothes for different occasions.

And the mechanics of fashion are... complex. If you walk into a store, think about all of the permutations of size, color, brand, style, etc. This is not to mention the thousands of pages found in e-commerce. All of this can be delivered to your doorstep.

But recently (and deservedly), the environmental implications of the fashion industry have been called into question. But adjusting existing processes will not suffice. Fashion needs a first principles overhaul. I believe unspun has the potential to do that.

Context: Waste of Textiles

Since the 1970s, global textile production per capita has doubled, and it continues to increase. We are consuming more textiles than ever.

Admittedly, there are two challenges with this number:

Textiles are not clothing specific (eg., includes home furnishings)

International market data is challenging to capture

So for these reasons, let's look at A) clothing & footwear and B) US-specific data. According to the EPA, Clothing & footwear production in the US has increased ~2x since 2000, and it continues to increase.

Most notably, ~70% of the generated clothing & footwear ends up in a landfill. Another ~15% gets burned. The percent of total generation that gets recycled has actually decreased since 2015.

The environmental impact of this is dramatically exacerbated by the rise of polyester fiber in our clothing. Cotton is biodegradable. Polyester is petroleum-based, and it is not biodegradable.

Furthermore, much of this production is never even used. Retail sales continue to shift to e-commerce, and this is increasing clothing return rates. Estimates have clothing return rates ranging from 15% to as high as 30-40%. Over 25% of returned merchandise goes directly to a landfill!!!! This implies +5-10% of global clothing production is thrown out just because of returns.

Sadly, this is just the low end. Retailers purchase clothing far in advance. If they cannot sell that clothing, the excess inventory is referred to as "dead inventory." This inventory is redirected to discount retailers, sent internationally, sent to a landfill, or burned. ~$50B of merchandise is wasted per year without ever being used... just in the US!

In summary, we are producing more clothing than ever. Most of the clothing gets burned or goes to landfills. The clothing we are making is increasingly petroleum-based. Of the clothing we produce, +5-10% of it is never even used.

Problem: Our current production process is broken & unclean

All of this excess and inefficiency stems from five major problems:

Globalized supply chain

Buying cycles

Consumer expectations

Raw materials

Disposal

Let's talk through them.

Globalized supply chain

For decades, clothing manufacturing has been off-shored from the United States. And it makes sense. The arbitrage of labor costs is so significant that it is cheaper to develop a complex, resource-intensive supply chain than to localize production.

China has been the largest beneficiary. Between 1980 and 2008, the estimated value-add of clothing in China has increased ~33x. This trend has only continued.

For decades, there have been few complaints. Prices decreased. The general public has been largely satisfied. But under the surface, the process is not... great.

From a humanitarian perspective, this price arbitrage comes at a significant cost. It is estimated 170M engaged in child labour. This means the child is either too young to work, or they are forced to do jobs detrimental to their health. Even for adults, it is seen as modern day slavery as many of the workers make <$100 per month of work. In addition, conditions are terrible. No examples are more prominent than the Rana Plaza disaster that killed 1,134 workers.

From a climate perspective, the optics are not great either. While relatively cheap on a per item basis, materials still travel obscene distances for production. A basic t-shirt can travel 39,000 miles prior to purchase.

This basic example from KQED shows the slight insanity of shipping raw materials across the Pacific to manufacture, only for them to be sold within a thousand miles of original harvest! The same can happen in a European supply chain (ex., Zara Dress).

Buying cycles

Harvesting cotton in Texas. Shipping to Asia. Milling in China. Sewing in Bangladesh. Shipping back to the US. This does not happen overnight. It takes time and planning!

The global supply chain is incredibly complex, so the buying cycles occur far in advance. Often, large retailers need to plan six months in advance (Note: Anecdotally, I have heard examples with greater lead times!). This creates a variety of complexities for retailers, most notably forecasting. If you are in merchandising, the long buying cycles require you to forecast demand far in advance. This is incredibly challenging.

For example, think of Nordstrom. They have 340 locations in the United States. Each store has tens (if not hundreds) of thousands of items. The permutations of style, size, brand, category are nearly endless. And they are expected to predict exact demand six months in advance for each, produce them abroad, and deliver them in-stock to match consumer demand. Impossible.

Consumer expectations

With the rise of fast-fashion, some retailers have been able to challenge the buying cycle length. For example, Zara can go from design to retail in five weeks, but this is paired with increased downside. Consumer expectations have increased dramatically. Consumers expect to find the right style, fit, or brand; otherwise, they will just leave! And with more than 20,000 Direct-To-Consumer (D2C) brands entering the market, they have more options than ever.

These expectations get pricey. They lead high-expense perks like free returns and significant over-orders. For example, H&M once had $4.3B of over-ordered inventory.

Raw materials

As discussed above in Exhibit 3, the rise in polyester-based clothing has been increasingly problematic. For fashion, it is a tight rope to walk. Consumer expectations are increasing, and two of the larger trends are 1) sustainability and 2) athleisure. But in many ways, these are inherently conflicting.

Much of sportswear is made with petroleum-based materials like polyester, nylon, etc. For example, Lululemon fabric (known as Luon) is 86% nylon.

Disposal

Well, if you are like most Americans, you may not want to compromise on our beloved athleisure fabrics. So let's recycle!!! Sadly, we saw in Exhibit 2 that we are not. This is largely due to incentives. It is both cheaper and easier to throw things out.

There are three main sets of incentives to consider:

Retailer - Make it financially beneficial for retailers to recycle

Consumer - Make it financially beneficial for consumers to recycle

Waste management - Make it financially beneficial for waste management to recycle

For retailers, continued pressure on retailers to be sustainable is moving the needle. Any additional government regulation will push that further. For retailers, it needs to be worth their time to recycle. An example would be Lululemon's buyback program. They repurchase used clothing & recycle it into new clothing!

The Lululemon program is also a creative solve to consumer incentives. Why would you throw out your Lululemon clothing when you could get store credit? Overall, however, it is very easy for consumers to toss clothing into a garbage bin and forget about it.

On the waste management side, it is actually quite challenging to recycle. It is handpicked! And even then, the material could be damaged throughout the process. In the end, it is cheaper for a waste management company to landfill it instead of recycle! For more information, I suggest you read about AMP Robotics.

Solution: On-demand production

These problems are highly systemic. Retailers actually do a pretty good job given the significant constraints they are placed in. Ultimately, the system needs to be rebuilt to solve these problems. Enter unspun.

When you click "purchase" or "buy" on a website, an order is processed, but the item you purchased was manufactured months before.

But imagine this. Next time you click buy, you are able to customize everything. Size. Fit. Color. Stitching. And within hours (maybe minutes), the clothing is manufactured in a small factory within hours of your location. This is the future that unspun is building.

On the surface, unspun looks like a custom denim brand, but really, they are reimagining manufacturing via customizable on-demand technology. Let me explain in three parts:

#1: The robotics: On-demand production

#2: The software: Matching demand and personalizing fit

#3: The brand: Proving the concept

#1: The robotics: On-demand production

Creating clothing instantaneously solves many problems. It allows for retailers to directly match supply & demand (no dead-stock). It also allows for agile changes in styles, colors, fits, etc. based on trends & demand.

The solution is automation. Build a machine that scales the production process. Adidas and Nike have seemingly successfully done this with shoes. Advancements in 3D-printing have made this possible, and it has decreased the time to produce a shoe ~4.5x.

So the obvious question: why have we not done this for clothing? 3D-printing leverages plastics & metals, both of which are not suitable for clothes, so that is not a potential solution.

Today, much clothing production can be very manual. Let's look at jeans for example.

Conventional process has been to automate mills to produce large sheets of fabric. The fabric is then cut into cookie cutter pieces (based on sizing), and then it is sewn together by hand in large factories (Note: mentioned above, these are often in Bangladesh, and they have poor working conditions). Each pair can take ~20 minutes to sew. Higher end jeans typically take much longer, sometimes hours.

Automating the sewing of these flat pieces has been nearly impossible, but unspun circumvents this by avoiding traditional practice on step 1!

Rather than create sheets of denim, unspun uses a large spool-like robot (size of a semi-truck!) to create pant legs. If you create hundreds of circles (of fabric) on top of one another, it creates a pant leg. In step two, the pant legs come out as one consistent tube, and the legs can be cut into separate pieces, much like sausage links.

This is an extraordinary breakthrough because of two reasons:

Variable sizing - Rather than cookie-cutter sizing, you can make each pant leg custom by just adjusting the size of the circles / diameter

Simplified cutting & sewing - Instead of cutting 7-10 different shapes, the different pant legs are just cut by the machine as they come out. Sewing is dramatically simplified

Drastically reducing steps - In traditional production, one factory converts yarn into fabric. The fabric then gets shipped somewhere else for production. With unspun, yarn goes in & comes out as pants. The best way to make a step efficient is to remove it entirely!

#1 provides much higher quality fit. #2 & #3 reduces bottlenecks & increases speed, so this can be done at scale. With these breakthroughs, unspun could theoretically manufacture made-to-measure jeans in <20 minutes as they scale. (Note: This is a long-term figure)

#2: The software: Matching demand and personalizing fit

This, of course, is extremely challenging. unspun wants to deliver variable sizing & on-demand manufacturing. While the robotics provide a hardware solve, it is only as effective as the specifications feeding into it. As a result, unspun has developed state-of-the-art software that makes two foundational changes:

Matches demand

Personalizes fit

When you purchase something on a retailer website, nothing happens on the manufacturing side. The retailer will identify the item you purchased. It is likely in a distribution center or store. Then their systems will figure the logistics behind delivery. But the factory itself is multiple worlds apart.

To have on-demand manufacturing, unspun's software is designed to connect the "buy" button to a factory. Eventually, when you purchase, a localized machine will actually turn on and begin developing your order. This directly matches demand (orders) to supply (clothing produced).

Because the software connects directly to manufacturing, unspun can completely personalize fit with variable sizing (mentioned above). Variable sizing, however, can be a double-edged sword. While they can improve fit & customization, variable dimensions are challenging to manage at scale. Standardization of sizing can help streamline production.

Traditionally, to get made-to-measure clothing... you needed to measure! This is done by a tailor. As you can imagine, this is highly manual. Go to the store. Meet a tailor. They measure. They log the measurements. They mock up a muslin sample. They send to production. The clothing is delivered. It is potentially altered. Etc. Each step leaves room for error, and it is not scalable.

A few years ago, however, there was a big breakthrough: Face ID & stereo-vision depth data.

The iPhone Face ID leverages the TrueDepth camera system. Overnight, millions of users globally could get hyper-accurate depth measurements from their phone. The cameras have improved dramatically (notice how there are three on iPhones now!).

unspun proceeded to develop proprietary software that takes a 3D body scan as an input, and it converts it to 3D sizing. Instead of just processing waist and inseam size, the software outputs perfect-fitting 3D model. The software takes a <10 second scan, and produces specifications for production on the back end. This:

Reduces costs - By automating the measurement process, unspun does not rely on manual labor (e.g., tailors) to get accurate measurements

Enables robotics - These accurate, digital prints are required inputs to eventually feed the robotic manufacturing

Unlocks scales - Removing the labor dependency & enabling the machinery will circumvent two of the largest bottlenecks

Improves over time - Customers can provide feedback on fit, which closes the feedback loop & improves the model over time; additionally, current retailers forecast trends & try to measure results based on standard sizing. unspun gets real-time accurate data, which is much more impactful.

Already, it is estimated that unspun has a fit rate of +90%, dramatically better than industry standard of ~70%.

Even better yet, this software does not have to be jean specific. As the model improves, it can be scaled (with some learning) to other clothing types.

#3: The brand: Proving the concept

Ultimately, these concepts are all great. Traditional retailers have felt their margins pressured by competition, supply chain challenges, excess inventory, high return rates, etc. Vertically integrating like unspun would be a HUGE boost, but... will it work?

Most people think of unspun as a jean brand, but coincidentally, they created the brand as a way to prove the concept. It was challenging to build the software without any data, so they needed to go get some.

Jeans are a unique place to start for a variety of reasons. First, it is a massive market (~$88B by 2027!), so there is huge opportunity. Second, consumers are willing to pay a premium for fit. This allowed unspun to prove the concept in a space where their unit economics could still be positive without scale.

Over the past few years, unspun has developed an amazing & unique jean brand.

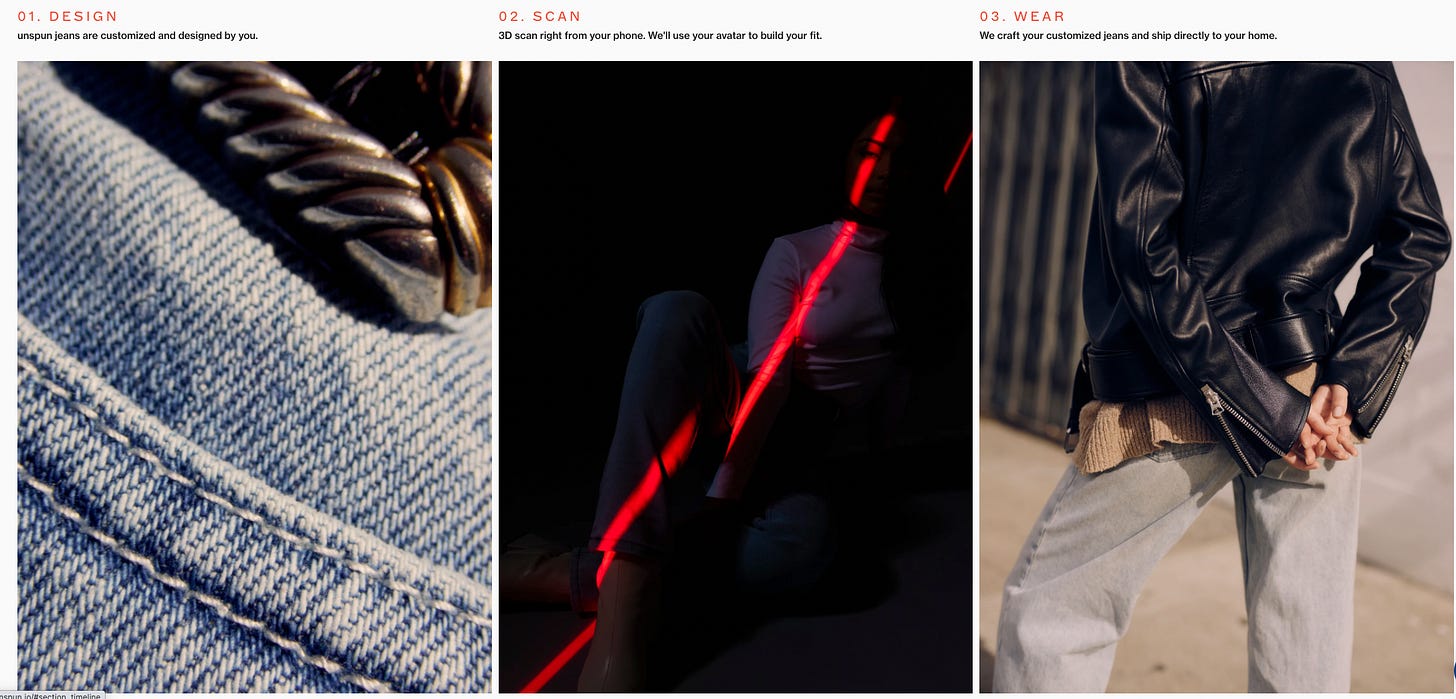

Customers go to their website & do a few quick steps. Design your jeans. Scan your body. Then receive them direct-to-consumer & wear them!

We have discussed the power of the scan & software, but it is a balance of art & science. While the scan gives unspun exact measurements, customers like wearing their jeans differently.

As a result, every customer is asked to customize jeans. Here's the interesting part: there are no sizes.

Customers start by deciding between slim, tapered, relaxed, and loose fitting jeans.

From there, customers can customize fabric, stitching, waist, and cuffs. The software suggests a combo, but it also allows users to fully customize, including visual aids. From there, the software combines all the user specs with the exact specifications you choose and... ta-da!! A custom pair of jeans is ordered.

Today, unspun can create & deliver these jeans in <30 days. This is already below industry standard. Long-term, unspun will leverage their robotics to make & deliver these jeans in potentially hours, not days.

Conclusion: The future of apparel

I was attracted to unspun when I tried them, and I was blown away by the fit. As a tall person, I struggle to find jeans that fit... until now.

But then, I realized the tech stack underneath the jean brand was remarkable. In particular, unspun attracted me for two reasons:

Magnitude of long-term vision

Multiple ways to win

Magnitude of long-term vision

Apparel is one of the larger, fickle markets out there. Especially in the US, consumers have distinct preferences, and the scale of climate impact is often overlooked.

But with unspun, the entire apparel supply chain could be disrupted and vertically integrated. There is a world where each region has a localized manufacturing (similar to Solugen) that rapidly produces clothing on-demand. In addition, the cost advantages will pile up. Reduced emphasis on labor. Lower return rates. Lower dead stock rates. It is the rare cross-section of unit economic advantage + social impact, fully aligning incentives.

For context of scale, unspun estimates that just 20 of their machines can produce ~1% of the US premium denim market in the US at a cost advantage.

One day, you may walk to a store. See jeans you like. Scan your body. Order them. They will be produced locally, and they will be ready for pick up within the day. All while reducing carbon impact.

Multiple ways to win

The long-term super bull outcome is a vertically integrated apparel brand. Retailer + Software + Hardware. But even if one sputters, unspun is remarkably operating successfully at all three individually.

The brand is growing & operating effectively. It could be a rapidly growing DTC brand in a huge space.

The software has nailed translating iPhone scans to production. Their return rates are dropping well below market normals. At the very least, they can whitelist their software to market leaders tomorrow.

Finally, if they solve the robotics question, they will be fully disrupting a traditional, manual model that already feels the pressure of climate and social rights activism. This will ultimately bring one of the largest industries in the world (apparel manufacturing) back locally to 1st world countries (including the US).

Appendix

One pager

Market sizing

The global apparel market reached $1.5T. This, of course, does not account for unspun's entire market opportunity. Here are three ways to look at it (from largest to smallest):

Cost of Goods Sold: unspun eats up the majority of cost of goods sold (remainder being raw materials) as they replace manual labor / production. Assumption here is that people will pay at least up to current costs to streamline (but not more)

Total waste: Total willingness to pay would be based on the $$$ savings would be

Denim market: unspun captures a certain amount of value in the denim market (where they are currently focused), and they do not expand beyond

The robotics have taken years, so I think it is fair to say the timeline to shirts, coats, etc. would take awhile. The software, however, might translate to other types of apparel quickly.

For opportunity, let's just keep it super simple, and we will assume they fully vertically integrate a portion of the denim market. The assumption is that this would roughly equal the sum of any parts they do separate (e.g., whitelist software):

Global denim jeans market size of ~$80B by 2025 (Source)

Option A: ~20 machines can scale to ~0.5-1.0% of the market → $4-8B

Option B: Estimated ~5-20% of costs in denim market to manufacturing & distribution → ~$4-16B

Finally, let's say they whitelist the software to other clothing. Even ~0.5% of the apparel market (~$0.50 on a $100 piece) would be ~$8B.

Some of these are additive, but in the end, I think these markets are ~$8-15B in opportunity. If they extend beyond denim, and they capture more value in the current manufacturing chain (very possible), then it could be quite a bit larger.

We can also sense check by just looking at dead inventory ( ~$50B of merchandise ), and this is notably higher. If you think they can improve this by 20-40%, it already extends beyond $10-20B.

Market factors

Tailwinds

Geo-politics - Coronavirus has brought forth a variety of concerns & issues globally. First, there are increasing concerns about supply chain fragility & dependence, particularly on China. With the invasion of Ukraine, there has been increased concern of China advances to Taiwan, further complicating matters. Overall, our foreign manufacturing dependence is both a security and economic concern

Sustainability - Brands are being increasingly pressured on carbon emissions. This may hinder the expansion and profitability of overall apparel industry, but it will increase the propensity to pay & investment into sustainable brands and technology

Social responsibility - Offshore manufacturing, particularly for fashion & luxury, continues to be a source of significant labor & ethical violations. This increase pressure will continue to push brands to identify new manufacturing practices, especially if automation & unit economic gains are possible

Headwinds

Commoditization - One of my biggest concerns for the market is competition. It has never been easier to start a brand. DTC brands are competing heavily by removing brick & mortar overhead. Large retailers are countering with private label brands that gain margin with massive scale. Amazon is pressuring the market entirely through scale & undercutting pricing (because they can support those losses with 80% margins on Prime memberships & cloud revenue... a topic for another day)

Hey, Jeff, nice to e-meet you through your awesome content! I've been making fashion startups since 2013, so I'm very much interested in following companies like Unspun. I like your analysis on tailwinds / headwinds. I went to the website and noticed that the jeans sell for roughly 200 USD. I don't know US prices, but in Ukraine where I am currently, we have Lee jeans selling for USD 50-100. Whats the USP of this kind of brand the Unspun are building which induces the audience to pay 2x for similar products?